For generations, most investors built their portfolios on one major foundational element: a 60/40 mix where equity represented 60% of the total funds invested and 40% reflected the bond allocation, explains Nell Sloane of Capital Trading Group.

It was as close as it got in finance to a “free lunch.” The positive and non-trivial expected return from each of the two assets combined with the low, often negative correlation between stocks and bonds resulted in a much higher information ratio for the overall portfolio. Or, in layman terms, a better risk-adjusted performance…essentially a free lunch.

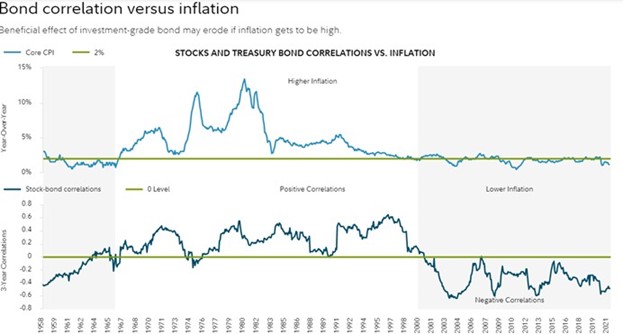

The negative correlation could be relied upon because of the tendency of bonds to provide safety to equity investors when things got dicey in the economy. As Main Street jammed, you could bet on aggressive lower rates to get the cycle restarted. Money would flow out of risky assets into the coziness of bonds resulting in a classic “flight to safety” dynamic and lower volatility in portfolios.

To quantify the historical advantage of a 60/40 portfolio, in the 20 years from July 2001 to June 2021, the annualized return was 7.42% with a standard deviation of 8.82 and a Sharpe Ratio of 0.72, versus an equity-only investment which would have returned 8.61% with a whopping standard deviation of 14.80 and a much lower Sharpe Ratio of 0.55 (source: Fidelity).

The following table shows the advantage of the negative correlation which investors enjoyed in the last 20 years. The chart also raises a red flag over the next few years as inflation may stick around for a while. Indeed, in the 1970s, another period of high inflationary pressure, the correlation between stocks and bonds turned significantly positive.

Source: Bureau of Labor Statistics, Global Financial Data (GFD), Bloomberg Barclays, Haver Analytics, Bloomberg Finance L.P., Fidelity Investments, as of 2/28/21.

A proactive investor would be well served in looking for alternatives to the traditional 60/40 mix. If we assume that inflation is at the core of the breakdown in the virtuous relationship between stocks and bonds and if we agree that inflationary pressure will last longer than expected, it would be reasonable to hedge portfolios with commodity exposure. Commodities do have a positive correlation with inflation and would help hedge that risk. Energy seems a clear winner and after a few years in the “cold,” valuations of energy assets and sector weights in most indexes are still at a historical low.

Other commodities, too, seem to be a good bet as the Ukraine-Russia war is exacerbating supply issues in many other basic materials and food chains.

Investing in commodities provides different options. For instance, one could invest in traditional equities which focus on basic materials only (think energy companies). This implementation would have the advantage of investing in an asset that would also pay dividends and make up for that bond coupon that would be lost by eliminating fixed income exposure.

A more direct strategy would be to invest in actual commodities, either via futures or options on crude oil, wheat, or any of the materials which are in tight supply.

Another possibility would be to look into CTAs and Managed Futures. Commodity trading advisors tend to implement trend following strategies often with a high correlation to commodity moves and historically have shown the ability to produce positive returns when equities floundered, the so-called “Crisis Alpha.”

And lastly, if one must have a risk-free component in the portfolio, Treasury Inflation-Protected Securities are still trading at decent valuations and can help mitigate the negative effect rising rates have on traditional nominal bonds.

Ultimately, in order to stress the importance at this temporal junction to strengthen portfolios with sound alternatives, we can defer to a pearl of wisdom by Steven Covey: “Strength lies in differences, not in similarities.”

Learn more about Nell Sloane by visiting Capital Trading Group

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is a risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.