Comments about upcoming interest rate cuts (or not) in a CBS interview with Fed Chair Jerome Powell spooked US equities yesterday, so the S&P 500 (SPX) paused to consider its next step, states Ian Murphy of MurphyTrading.com.

On the price chart, the pullback appeared mild, but under the surface, trouble may be brewing because 23.8% of all US stocks made a new 20-day low during the session. The selloff drove the Pessimism Indicator sharply upwards and well out of its channel (arrow), which means the anticipated Help Strategy trigger in SSO never materialized.

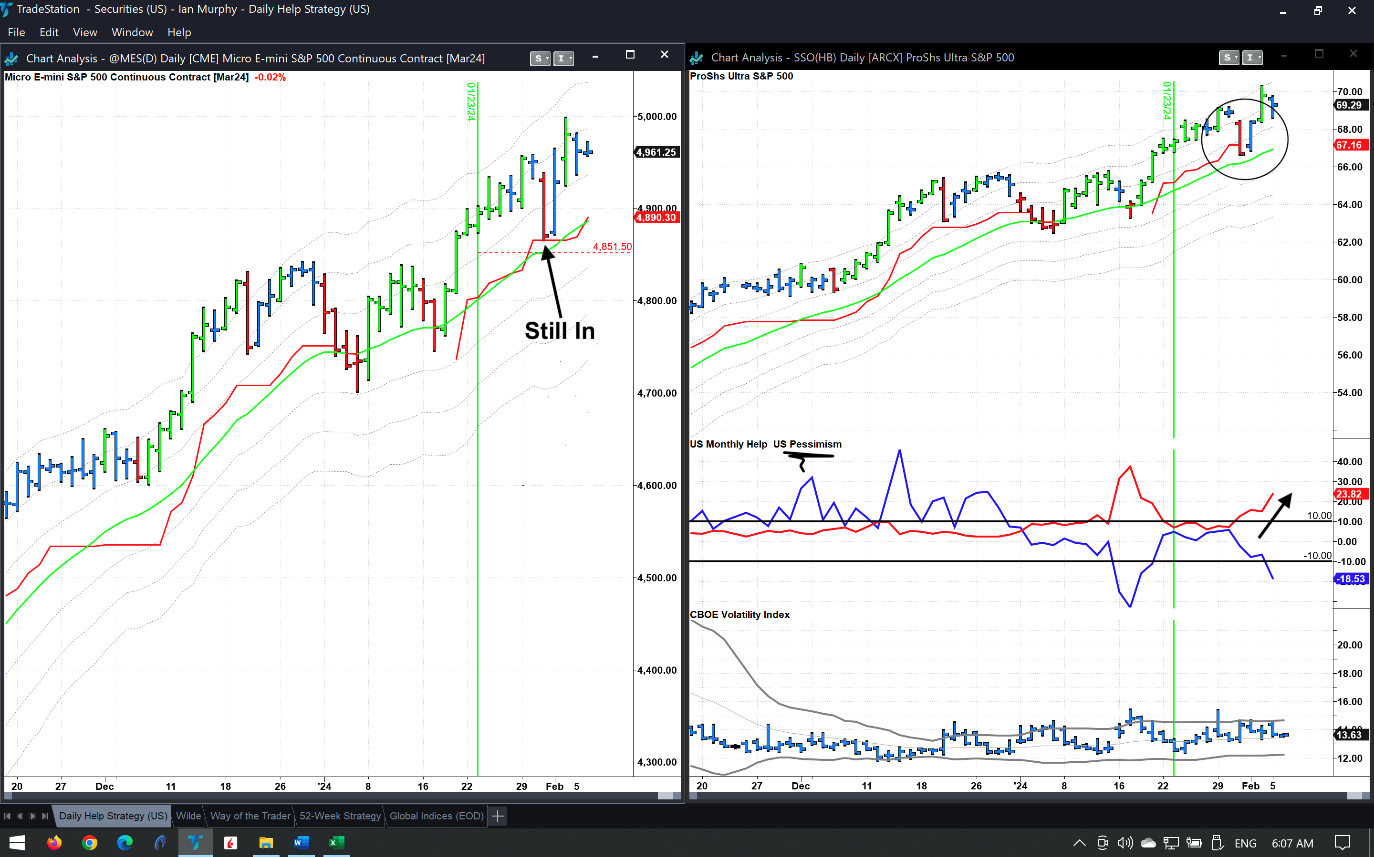

If you recall, the SSO position was stopped last Wednesday (right chart) but the loss was limited to just 0.33% thanks to the trailing stop, whereas the position in Micro E-mini futures of the S&P 500 (CME: MES) is alive and doing well (left chart).

I’ve been asked if the fact that SSO was stopped out already should be a reason to close the futures trade. I don’t think so. Why would we? If the trailing stop keeps ticking up there is no reason to get out as the potential loss is being reduced during each session. As it stands, the Micro position opened on Jan 23 at 4895 and the trailing stop ticked up to 4869.25 yesterday so a sharp selloff which triggers an exit today will be a 0.5% loss. If the stop stays where it currently is at 4890.25 (rounded to the nearest 0.25) it will only be a 0.1% loss.

The price is currently 1.5ATR above the stop, so it’s entirely possible futures could pull back and recover without hitting the stop. I would stay with it.

Learn more about Ian Murphy at MurphyTrading.com.