This article will highlight one of the many ways we can establish a monthly covered call writing portfolio during bullish market conditions. We will utilize a hypothetical portfolio of $100k and use five different securities, three stocks, and two exchange-traded funds (ETFs), states Alan Ellman of The Blue Collar Investor.

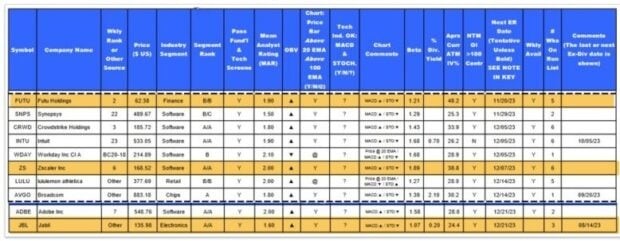

Premium Stock Report for the November 2023 Contracts (10/23/2023 – 11/17/2023)

- FUTU, ZS, and JBL are eligible securities in three different industry segments.

- No earnings reports are due before the expiration of the November 2023 contracts.

- All have adequate option liquidity (open interest- OI).

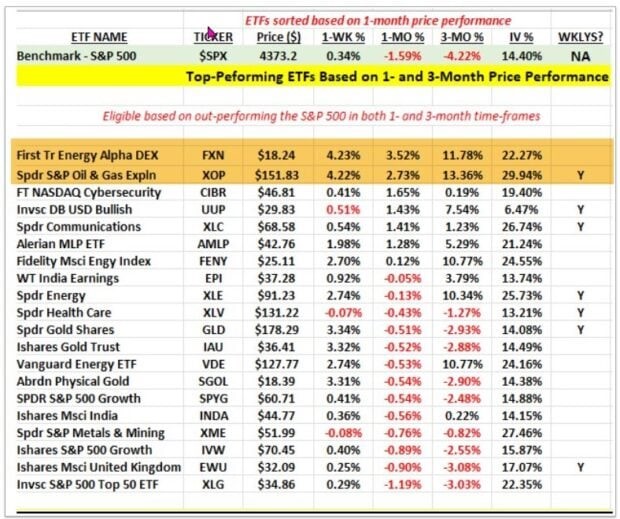

ETF (Exchange-Traded Funds) Report for the November 2023 Contracts (10/23/2023 – 11/17/2023)

- FXN and XOP are the two top-performing ETFs the week before the November 2023 contracts start.

- Both securities have outperformed the S&P 500 over the one-month and three-month time frames.

- Both the stock and ETF reports are included in our BCI premium membership.

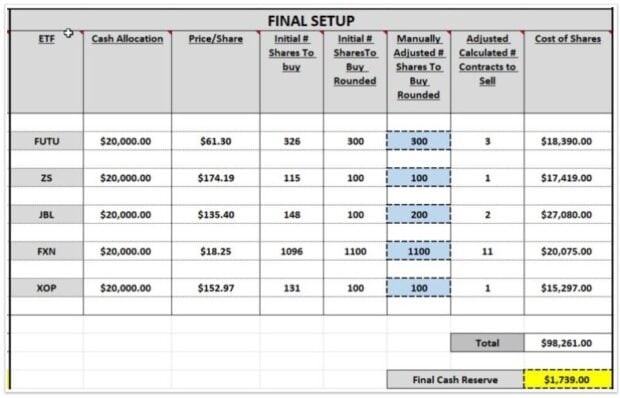

Cash Allocation Spreadsheet

- The final portfolio setup spreadsheet displays the # of shares to buy and contracts to sell while allocating a similar amount of cash to each position.

- There will be a cash balance of $1739.00 for potential exit strategy opportunities.

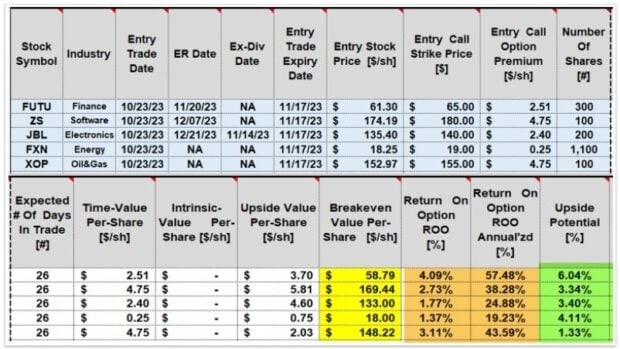

Initial Portfolio and Trade Calculations Using The BCI Trade Management Calculator

- Initial time-value returns range from 1.37% to 4.09% for the 5 positions (brown cells).

- Annualized initial returns range from 19.23% to 57.48% for the 26-day trades (brown cells).

- These are initial returns. Final returns can be higher or lower.

- Since all strikes used were out-of-the-money (OTM), upside potential ranged from 1% to 6.04% (green cells).

Discussion

Setting up a high-quality covered call writing portfolio, involves several considerations. Here are some:

- Stock and ETF selection based on sound fundamental, technical, and common-sense principles.

- Adequate security diversification.

- Adequate cash allocation.

- Strike selection based on overall market assessment, personal risk-tolerance, and chart technical parameters.

There are many other ways to establish our portfolios for each contract cycle. This article provided an example that utilized many of the critical principles we can employ to ensure the highest possible returns. Remember, this publication did not address position management, the third required skill needed to achieve the highest possible returns.

Learn more about Alan Ellman on the Blue Collar Investor Website.