Socially conscious investors looking for an alternative to money market mutual funds may want to consider PIMCO Enhanced Short Maturity Active ESG ETF (EMNT), suggests Jim Woods, editor of The Deep Woods — in the third of 3 articles on socially-responsible ETFs.

As an actively managed exchange-traded fund, compared to a money market fund, EMNT seeks greater income and total return potential by investing in short-term debt securities with an environmental, social and governance (ESG) screen. That approach makes EMNT ideal for socially conscious investors.

In looking to provide higher income than the average money market mutual fund, EMNT holds a variety of high-quality and ultra-short-term U.S. dollar-dominated debt, along with investment-grade securities.

Read part 1 of this article here.

Read part 2 of this article here.

Investors will not solely be exposed to U.S.-based debt, since they will be exposed to U.S. dollar-denominated securities from developed countries and emerging markets, too. The fund aims to keep the average holding duration under one year and seeks to maintain a dollar-weighted average for less than three years.

This open-ended fund has a net expense ratio of 0.24% and $87.54 million in assets under management. Year to date, the fund has a total return of 1.30%.

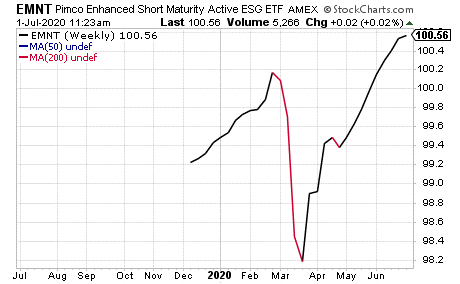

As depicted in the chart below, EMNT dropped sharply in mid-to late-March. However, starting in early April, the fund began to climb. Plus, the fund hit an all-time high market open of $100.56 on July 1. This showed a rise of 0.05% from the previous day’s close.

PIMCO, the creator of PIMCO Enhanced Short Maturity Active Exchange-Traded Fund, found that not only were investors looking to move away from money market mutual funds, but ESG was becoming a priority as well. In order to satisfy this pool of investors, EMNT is unique as it works to avoid investing in securities of issuers whose business practices, in terms of ESG, are not up to par with PIMCO’s proprietary assessments.

Though PIMCO has a set of criteria for its EMNT investments, it initially may engage with issuers whose ESG practices are suboptimal in hopes that through the initial engagement, their practices may improve.

For socially conscious investors who are looking for a greater income and greater return potential, Enhanced Short Maturity Active ESG ETF may be worth consideration.