Specialty retailer Children’s Place (PLCE) has a lot going for it right now, asserts Paul Price, columnist with TheStreet.

Here are five major tailwinds in place for the company:

- Parents skimped on kids’ clothing last year as most students did not physically go ‘back to school’ due to covid-related reasons. This year those children are a year older, a lot larger and their clothes are in need of major upgrades.

- President Biden’s aid to families with children began distributing substantial electronic payments this month. That program is scheduled to go on for quite a while with the ultimate political goal to make the payments permanent.

- Children’s Place has vastly improved its online presence and fully integrated its purchase of industry rival Gymboree.

- Many unprofitable stores were closed during the covid shutdowns. Charges for those closures were already accounted for but the improved margins on the remaining units are just starting to fully kick in.

- It is likely that management will reinstitute cash dividends before long, providing a larger universe of potential institutional holders.

The CEO of Macy’s (M) was recently on CNBC saying that he expects this fall to be the best ‘back to school’ season in that venerable company’s history.

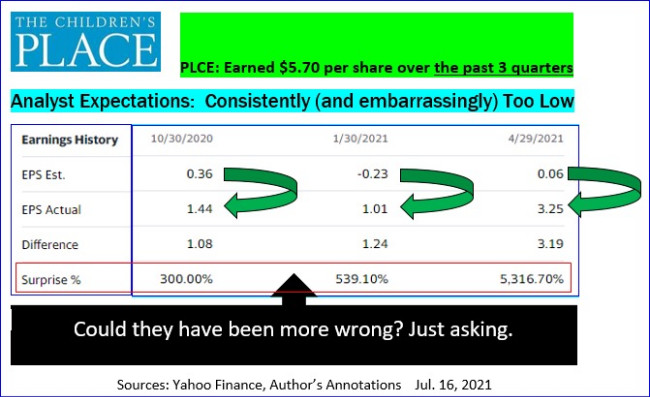

Analysts have been way too slow in realizing just how favorable conditions for PLCE have become. Their estimates over the past three quarters were pathetically off by percentages that seem to be typos, but weren’t.

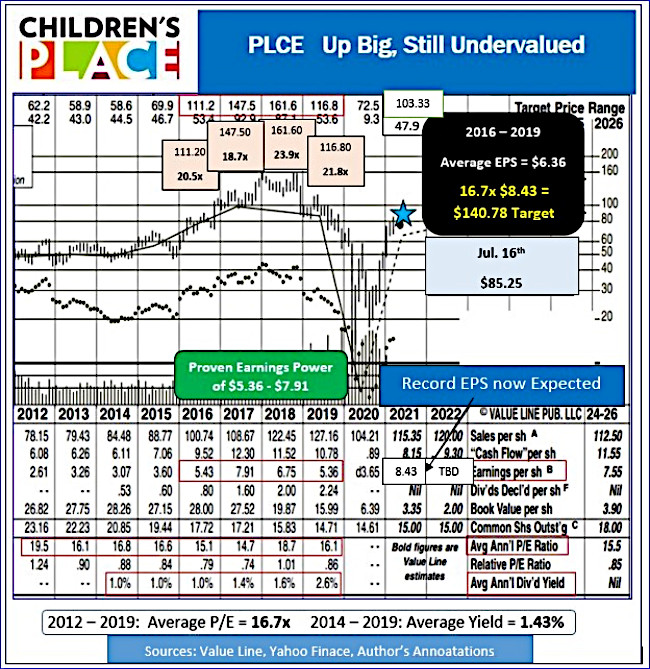

Over those nine months of actually reported results, PLCE posted $5.70 in EPS. The end of July quarter last summer marked the very bottom of PLCE’s covid woes. They lost $1.48 in adjusted earnings during that interval last year (per Yahoo Finance). Even a modest profit this year will make trailing 12-months EPS at least around $7.50.

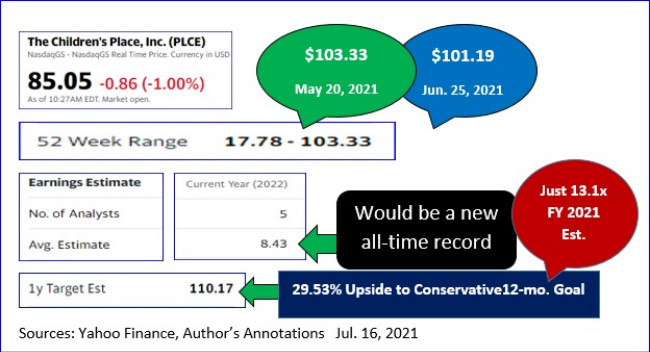

Yahoo Finance now projects $8.43 for PLCE’s full fiscal year ending January 29, 2022. Based on their past forecasting history that number might well turn out to be too low.

What is PLCE really worth? In the eight pre-covid years a typical multiple ran about 16.7x. Applying that P/E to this year’s estimate supports a greater than $140, 7-month price target.

That goal is not farfetched. PLCE peaked between $111.20 and $161.60 during each of the four years stretching from 2016 through 2019. The shares hit $103.33 in May of this year. They still commanded over $101 as recently as Jun. 25, 2021, just a few weeks ago.

With all-time record results on tap there’s every reason to think PLCE can eventually exceed all those old highs.

Buyers of PLCE’s Jan. 2023, LEAP calls at $130 and $140 were paying $12.50 and $10.30 respectively on July 16th even with the stock down for the day, and near $85. They won’t even start to make money on expiration day until PLCE passes $142.50 or $150.30.

Buying shares outright is a simple, plain vanilla, way to bet on PLCE’s fine prospects. Selling puts, or setting up buy/write combinations could work out brilliantly, too. Disclosure: Long PLCE shares, short PLCE naked put and covered call options.