If you’re looking for an in-depth write-up about the various cryptocurrencies, look elsewhere — we don’t pretend to be experts on all the different machinations of crypto, notes Mike Cintolo, growth stock expert and editor of Cabot Top Ten Trader.

But whether this movement leads to a new, open financial system or not, it’s clear that perception continues to move in the sector’s favor, with these currencies becoming more accepted by various people and payment firms out there. There are an increasing number of ways to play the group (including many ETFs), but Coinbase (COIN) is the one that intrigues us most.

It certainly looks like the NYSE or Nasdaq of the crypto world, with the leading platform for both individuals (8.8 million users in Q2) and institutions (9,000 total have signed on, including 10% of the largest 100 hedge funds) to buy, sell and store bitcoin and other products thanks to its deep liquidity and some proprietary order execution algorithms.

Transaction volume is the real driver right now (making up 95%-plus of revenue), and bringing more products to the platform is a key growth initiative (bitcoin now makes up “just” 47% of assets on the platform; Ethereum is 24% and all others are 30%).

Coinbase is also expanding into adjacent offerings (both by itself and through partners), even including a debit card to allow users to pay using their Coinbase crypto holdings at millions of merchants around the world.

The risk here is that a sustained downtrend in bitcoin and other crypto assets could lead to a huge decline in trading volume (indeed, analysts see a big retrenchment in earnings next year), but right now, there’s no doubt growth has been amazing, not just in sales and earnings, but via trading volume ($462 billion in Q2, up 38% from the prior quarter!) and users (up 44% sequentially). The next report is coming November 9.

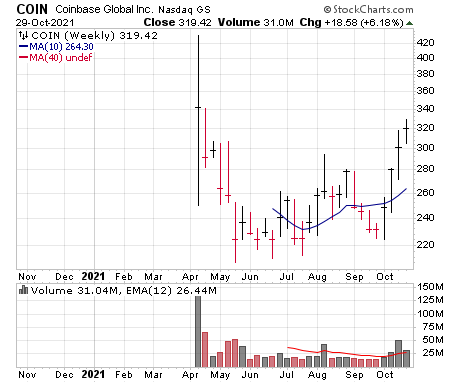

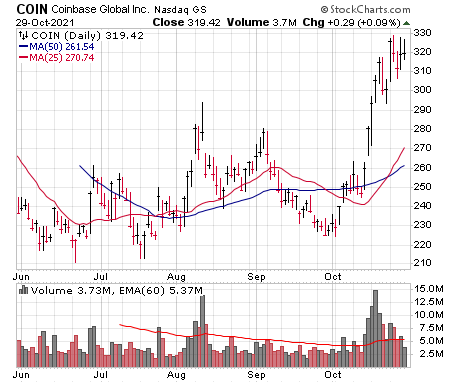

COIN came public in April and promptly splattered all over the floor, falling from an IPO day high of $460 to a low of $208 in May. But then the stock improved its standing, not by going up but by spending five months building a solid bottom in the $210 to $225 area.

And now, for the first time, we’re seeing legitimate bullish action in COIN, with a five-day buying volume cluster two weeks ago, and follow-on buying since. A shakeout ahead of earnings (November 9) could be an opportunity for a small stake.