GXO Logistics (GXO), which was spun off from giant transport outfit XPO Logistics (XPO) back in August, is the largest pure-play contract logistics provider, with 869 warehouse locations (totaling 208 million square feet), observes Mike Cintolo, editor of Cabot Growth Investor.

Of course, transport outfits aren’t our usual targets, but GXO has a solid growth story: Short term, of course, the supply-chain issues are headline news, and longer term, the mix of more e-commerce and move toward outsourcing logistics are huge opportunities.

GXO’s client base includes names like Disney, H&M, Ross Stores and a bunch of international giants (Zoloando is one of Europe’s largest e-commerce outfits), and business is good and getting better.

So far this year, the company has expanded operations with 16 of its largest 20 customers, and in Q3 alone, it added $1 billion of contract value, with average contract duration numbering a few years in length, adding reliability to its growth outlook.

Indeed, that reliability is a big part of the story: While GXO isn’t going to grow at lightning-fast rates, it has visibility into 2022 and even 2023 given its long-term contracts, looking for double-digit-ish organic revenue growth (M&A should add to that) with cash flow and earnings (analysts see the bottom line up 44% next year) growing even faster.

Better yet is the big-picture view that, especially with so many supply snafus this year, the desire by big companies to outsource part or all of their logistics operations should spike.

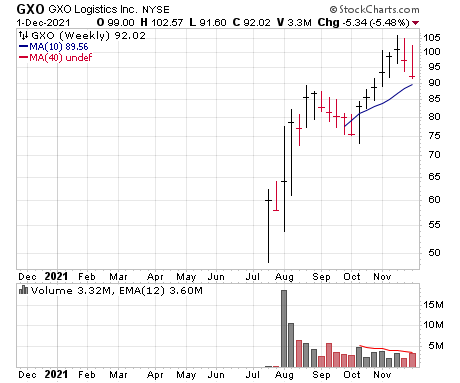

The stock recently marched up six weeks in a row before hitting resistance near $100, and its pullback since then has been very reasonable, which is impressive given the market and the action of its peers. It’s not a traditional growth name, but GXO has the makings of a winner.