I’m a big fan of “pick and shovel” stocks. They take their name from the California gold rush and center on the idea that it was the folks selling the tools the prospectors needed, rather than the gold-fevered miners themselves, who made all the money! explains Brett Owens, chief investment strategist at Contrarian Outlook.

A good example of how a pick-and-shovel play works in your favor is Crown Castle International (CCI), which gives big telcos like AT&T (T) and Verizon Communications (VZ) the cell towers they need to send their signals zipping through the air.

CCI is cashing in on soaring mobile-data consumption, thanks to its 40,000 cell towers and 80,000 small-cell nodes, which work in tandem with towers to improve connectivity in urban cores, where demand is high.

One of the things we love about CCI is its smart capital allocation: it nicely splits its investments between shareholder returns (i.e., dividends and buybacks), acquisitions and building new towers.

The company is also doing a good job of leveraging still-low interest rates to fuel its growth while maintaining a healthy balance sheet that will bolster it when rates do start rising. As I write, CCI’s $20 billion of long-term debt is around half the value of its assets and a quarter of its $82-billion market cap.

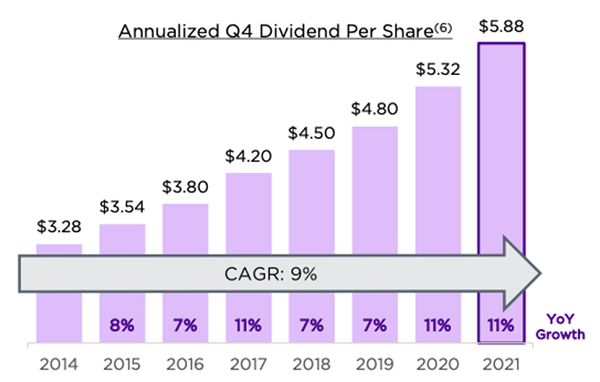

These investments have resulted in rising revenue, the benefits of which flow through to investors as dividend hikes. CCI’s stated yearly dividend-growth goal is 7% to 8%, and it’s been crushing that benchmark!

CCI’s stock performance is also a textbook example of how pick-and-shovel stocks beat the “prospectors” every time: it’s blown past its “tenants,” Verizon Communications and AT&T, over the last decade, even including the big dividends the telcos are known for.

Finally, even though we’ve been talking about soaring mobile data use for a decade, our smartphone addiction is still getting stronger: according to 5G network supplier Ericsson, North American mobile data use will hit 52 gigabytes per smartphone in 2027, up from just 14.6 gigs in 2021, as data-hungry applications like virtual reality come into their own. CCI is sitting squarely in the tracks of that trend.