Traders are adjusting to the new reality of likely Federal Reserve interest rate hikes and rising bond yields. That combination represents two headwinds for the high-valuation stocks currently that are “priced to perfection,” explains Jim Woods, editor of Bullseye Stock Trader.

That’s why in the weeks and months to come, we will be making sure our selections have very strong earnings profiles. We’ll also be looking at stocks with strong price momentum in sectors that are currently in favor, and that also do well in a rising rate/higher bond yield milieu.

One such sector is energy, particularly oil and natural gas stocks. Indeed, crude oil prices are surging on a combination of rising inflation, steady demand and constricted supply. Those rising prices have created a bullish setup in several marquee oil stocks, and one that I like for inclusion today in the best portfolio is Oasis Petroleum (OAS).

Oasis Petroleum is a U.S.-based independent exploration and production company that operates in two segments: Exploration & Production (E&P), which is engaged in the acquisition and development of oil and gas properties; and Midstream.

The company generates the majority of its revenue from the E&P segment, and its big areas of production are properties in the North Dakota and Montana regions of the Williston Basin, as well as the Texas region of the Permian Basin.

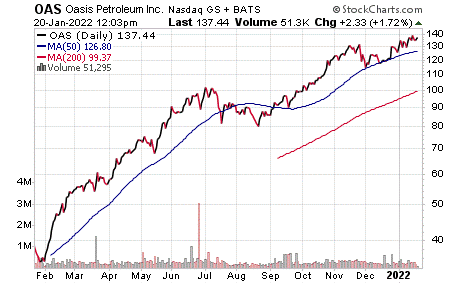

Over the past several weeks, OAS is up some 8.8%, while the tech-heavy Nasdaq Composite is down some 8.3%. That tells you right there where the smart money is flowing. Yet, the gains in OAS aren’t just a recent rotation fad. Shares are up some 27.5% over the past three months. Over the past 12 months, OAS has delivered a gain of 216%.

That performance over the past year puts OAS shares in the top 1% of all publicly traded stocks in terms of relative price strength. And, as for earnings, the company is in the top quartile of stocks in the market in terms of earnings per share growth over the past several quarters and years.

OAS is set to report earnings on February 22; I expect more smart money to run to the energy sector, particularly one of its leading stocks, i.e., OAS, in the lead up to that report. That means owning the shares now could deliver a big bullseye win for us in the weeks to come.

Technically speaking, OAS shares are breaking out of a bullish cup-with-handle chart pattern as they move through new 52-week highs. This is a move which I suspect can take the shares higher, including well into the mid-$140s.