As interest rates go up, the value of current bonds goes down. Moreover, bonds that have a longer duration go down in value faster as rates rise, because the lender’s money is tied up in the loan for longer as rates go up, notes Michael Foster, investment strategist at Contrarian Outlook.

But this time, long-duration bonds are way oversold; the market is selling off long-duration bonds in exchange for short-duration ones because long duration bonds are likelier to lose value as interest rates drop.

However, in doing so, the market has already priced in the interest-rate risk that long-duration bonds are facing, which means some bonds have gotten oversold as they offer good rates of return and relatively low risk.

In such a situation, your best bet is to buy a well-managed corporate-bond closed-end fund (CEF) like the Western Asset High Income Fund II (HIX), an 8.6%-yielder that’s well diversified across the bond space, with 270 holdings and an average duration of 6.25 years.

This is a bit long, but remember, we’re buying it because it’s buying those longer duration bonds when they’re oversold. It holds 94% of its portfolio in corporate bonds, and these issues provide a healthy average coupon rate of 7.9%. The fund also trades at a slight discount to NAV (or just below the value of the bonds in its portfolio) as I write this.

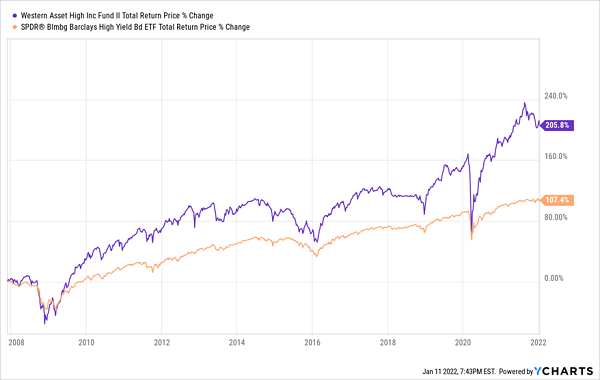

The real reason why we want a CEF like HIX, though, as opposed to a passive ETF or the high-yield benchmark SPDR Bloomberg Barclays High Yield Bond ETF (JNK), boils down to one thing: active management.

HIX Soars Past Its Benchmark

HIX is run by Western Asset, which has been around since 1971 and boasts a management team with a keen eye for oversold bonds, which is why they’ve nearly doubled the high-yield bond index fund’s return since that fund’s inception. (HIX has been around since 1998.)

This is just the kind of eye for value we want in a market like the one we’re facing now. And best of all, HIX’s 8.6% dividend, which has held steady through the pandemic, gives us a steady income stream that runs well ahead of inflation.