We aim for critical guidance on which stocks have the most potential to generate profits, and how to avoid those most likely to steer you into a ditch, asserts Mike Larson, growth and income expert and editor of Safe Money Report.

When you pair them with cycle-based navigation aids, you have a great market map. That brings me to this month’s Bedrock Income Portfolio recommendation.

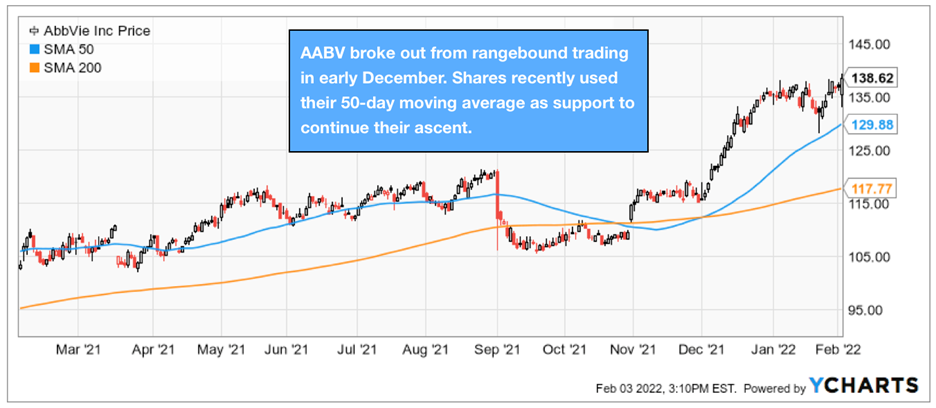

Buy a new, smaller position in a promising, pharmaceutical play that’s climbing the Weiss Ratings ladder: AbbVie (ABBV) Based in Chicago, AbbVie is a pharma firm with current or future therapies focused on the immunology, oncology, neuroscience and eye-care markets, among others.

Some of its better known drugs include Skyrizi (plaque psoriasis), Rinvoq (rheumatoid arthritis) and Imbruvica (lymphoma and leukemia applications).

AbbVie just reported solid Q4 results. Adjusted earnings per share (EPS) came in at $3.31, beating the average estimate of $3.28. Revenue climbed 7.4% to $14.9 billion.

Strong sales and its promising therapeutic pipeline gave the company the confidence to forecast $14–$14.20 in 2022 EPS. The midpoint of that range beats current per-share estimates by 11 cents.

When it comes to income, there’s a lot to like, too. ABBV recently raised its quarterly payout more than 8%, to $1.41 per share. That’s good for an indicated yield of around 3.8% at recent prices — not to mention more than triple the yield on the SPDR S&P 500 ETF (SPY).

The shares also earned more plaudits from our ratings system recently. Improvements in growth, volatility and valuation metrics fueled two half-step upgrades, leaving ABBV at a “Buy” rating of “B” as of this month.

Bottom line? Select pharmaceutical picks have been coming back nicely as money rotates into cheaper, cycle-appropriate names. So I recommend you add more exposure to this trend with ABBV. Keep it small for now. Also, for disclosure, I own AbbVie in my personal portfolio.