I’m a huge fan of drug companies, and I am against the popular notion of demonizing “Big Pharma.” I think the brilliant scientists who develop lifesaving and life-enhancing therapies are modern-day heroes, notes Jim Woods, editor of Bullseye Trader.

Today, one such collection of scientists, along with all the other men and women who work toward the common goal of creating value for this company, has resulted in a new Bullseye Stock Trader recommendation.

That company is Eli Lilly and Co. (LLY) — a drug firm with a focus on neuroscience, endocrinology, oncology and immunology. Lilly’s key products include Alimta and Verzenio for cancer, Jardiance, Trulicity, Humalog and Humulin for diabetes and Taltz and Olumiant for immunology.

In February, LLY reported strong earnings, but those numbers were slightly below estimates. However, LLY has been very strong on the earnings front, with recent quarterly and annual earnings per share (EPS) growth in the top 11% of all public companies.

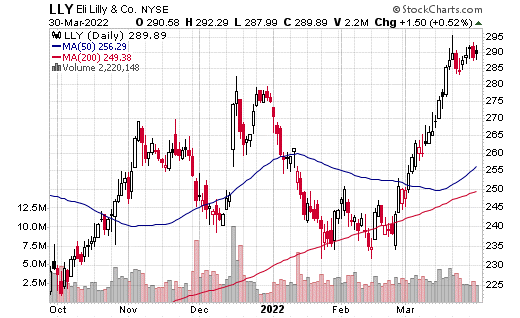

On the share price front, LLY’s 52-week gain of over 56% puts that stock in the top 7% of all companies on a relative strength basis.

Technically speaking, LLY shares are now forming a new base after a big recent run over the past month of nearly 16%. That run saw LLY break back above its 200-day and 50-day moving averages toward a new 52-week high.

On the news front, the company’s bottom line was boosted by its COVID-19 therapies. Yet more importantly, LLY has a powerhouse pipeline of new drugs on tap, including a new therapy designed to combat Alzheimer’s.

The next earnings release for LLY is slated for April 28. I suspect the shares will make a steady run higher over the next several weeks leading up to what I anticipate will be a solid Q1 report. If I’m correct, that will mean another big winner in the our portfolio.