Inflation is staying at 40-year highs; here’s an overview of what to do, explains Louis Navellier, editor of Navellier Growth — and a participant in The MoneyShow Las Vegas on May 9-11.

In anticipation of the new inflation numbers this past Tuesday morning, stocks took a beating while U.S. Treasury Yields rose to three-year highs.

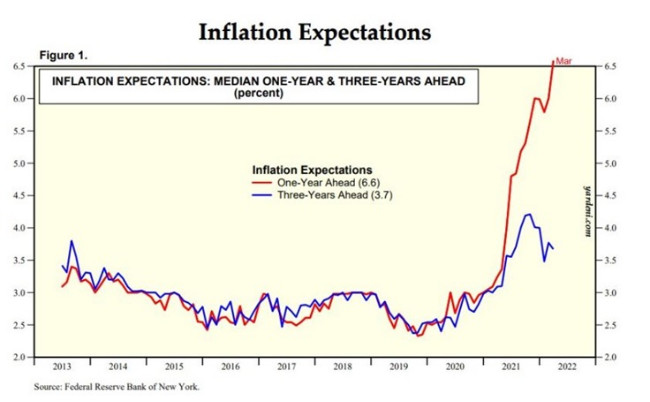

In fact, Monday, the Federal Reserve Bank of NY reported: “Median one-year-ahead inflation expectations increased again in March, climbing from 6.0% in February to a new series high of 6.6%.”

This sent expectations off the chart:

The Biden administration also tried to warn folks, stating that it anticipated inflation to be “extraordinarily elevated.” So, it was interesting that the broader market rallied strongly after the Consumer Price Index (CPI) reading, which measures consumer inflation, was released on Tuesday.

And, boy, was it ugly. The CPI rose to 8.5% year-over-year, slightly above economists’ forecast for an 8.4% year-over-year jump. That’s on top of the recent reading for the Personal Consumption Expenditure (PCE) index, the Federal Reserve’s favorite inflation gauge. The PCE rose at a 6.4% annual pace through February.

The core PCE, which excludes food and energy, is running at a 5.4% annual pace. The Fed still wants to see PCE closer to its 2% annual target, but I expect it will take at least until 2023until it reaches that inflation goal.

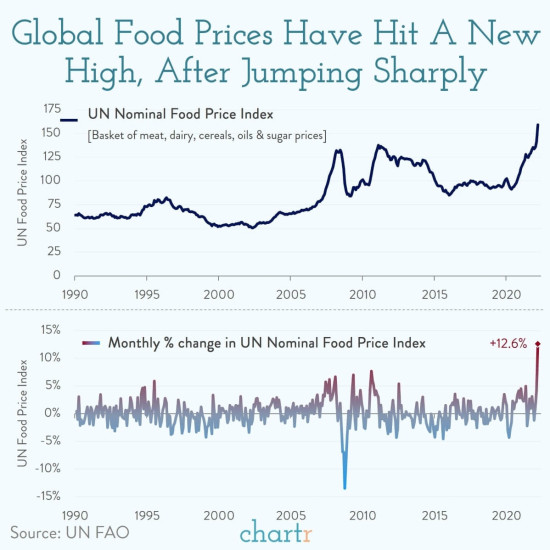

And those numbers only tell part of the story. The UN Food and Agricultural Organization recently reported that the Food Price Index rose 12.6% in a single month. That’s the highest recorded level ever. Everything is more expensive… and there doesn’t seem to be an end in sight.

I’d like to review what’s causing this massive surge of inflation and the Fed’s likely action… and most importantly, how you can profit in this inflationary environment.

Inflation’s Surge

Inflation is the purchasing power of cash — how much you can buy for $1. In a healthy economy, inflation rises about 2% yearly. The recent rise in inflation can be attributed to ongoing supply chain issues that started with global COVID-19 shutdowns, increase in demand, the Fed’s quantitative easing policy and the Russian/Ukrainian war.

For most of last year, Federal Reserve Chair Jerome Powell has said that the inflation situation is “transitory,” and prices would level out. It wasn’t until late 2021 that the Fed finally changed its tune.

As reported by CBS in late November 2021, when asked by lawmakers about the change of heart, Fed Chairman Jerome Powell acknowledged the central bank did not predict the supply chain issues in its projections.

Then last week, Fed officials warned that inflation was out of control and were prepared to take swift action to get prices back to normal. In fact, the latest Federal Open Market Committee (FOMC) meeting minutes revealed that our central bank has grown more aggressive and more hawkish in its efforts to curb soaring inflation.

The minutes confirmed that the Fed will reduce its quantitative easing by $95 billion per month, with $60 billion in Treasury securities and $35 billion in agency debt.

To understand how aggressive this move is, consider this: The last time that the Fed pruned its balance sheet was back between 2017 and 2019, and it did it in $50 billion increments. Clearly, the Fed wants to shrink its balance sheet quickly, as it stands at nearly $9.0 trillion due to the COVID-19 pandemic.

In light of this morning’s numbers, it’s growing more and more likely that the Fed will raise key interest rates by 0.5% several times this year. Most Fed officials are onboard with 50-basis-point increases but opted for the 0.25% hike at the March meeting due to global uncertainty and fears of driving the U.S. into a recession.

But it’s not all bad news. My favorite economist, Ed Yardeni, reported that, “longer-term inflation expectations over the next three years ticked down to 3.7% from 3.8%” and that he expects inflation to peak sometime mid-year. But no matter when inflation calms down… middle of this year, sometime in 2023 or later… there are things we can do as investors to set ourselves up for success.

Your Inflation Protection

If you are looking to offset rising prices you should be focusing on strategic inflation hedges. I use my quantitative investing system to find the strongest fundamentally superior stocks that are well-positioned to do well in any market environment. In other words, these are companies that continue to boast strong sales and earnings growth and see persistent institutional buying pressure.

Right now, my system is flagging high-quality energy, food and shipping and semiconductor stocks that are still growing their sales and earnings. These are the companies that are set to benefit from the recent surge in inflation. They’ll also help protect your portfolio if the U.S. economy slips into a recession, though that’s unlikely right now.

The bottom line: Your best defense in an inflationary environment is a strong offense of fundamentally superior, inflation-proofed stocks.

To find out what stocks I like this year, please click here to view my special report, “The 11 Best Stocks for 2022.” It’s yours, absolutely free. Once you sign up, you’ll also receive my Market360 newsletter every Tuesday, Thursday, Friday and Saturday. In this newsletter, I share my latest market insights, as well as my thoughts on stocks, different trends and the latest economic data.