New Fortress Energy (NFE) is an integrated gas-to-power company that provides modern infrastructure solutions to create cleaner, reliable energy, explains Jim Woods, in his speciality trading service, Bullseye Stock Trader.

Its business model spans the entire production and delivery chain from natural gas procurement and liquefaction to logistics, shipping, terminals and conversion or development of a natural gas-fired generation. Geographically, it has operations in North America, the Caribbean and Europe.

As we all know, the price of oil and natural gas has been elevated by the supply constrictions emanating from Russia’s ghastly war on Ukraine. That’s caused a reallocation of capital into domestic firms that produce these key ingredients needed to power the planet.

How much of a reallocation to capital are we talking about? Well, consider that in its most-recent quarter, NFE grew its earnings per share (EPS) by an astronomical 7,100%! Yes, you read that number correctly.

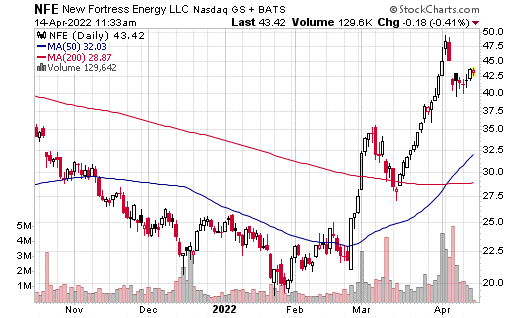

As for share price appreciation, so far in 2022, NFE shares have spiked by nearly 79%. And over the past month, the stock is up 41%.

Now, the recent spike higher in NFE has settled a bit over the past week, which I was waiting and watching for. That’s because the pause here represents what I suspect will be a new launching pad for the shares as we head into the next quarterly earnings release.

The earnings release has now been confirmed by the company to occur before the opening bell on Thursday, May 5. Buy New Fortress Energy LLC at market, with a protective stop set at $38.15.