There's nothing that closed-end fund (CEF) investors love more than finding a smartly run fund in an unfairly beaten-down sector; this hands us a nice discount plus a much bigger dividend, asserts Michael Foster, editor of CEF Insider.

In fact, with CEFs, we're actually getting a "double discount" — one from the depressed sector and one from the CEF's discount to net asset value (NAV, or the value of the stocks in its portfolio). This indicator only exists with CEFs, and we'll cover 4 with particularly attractive discounts to NAV.

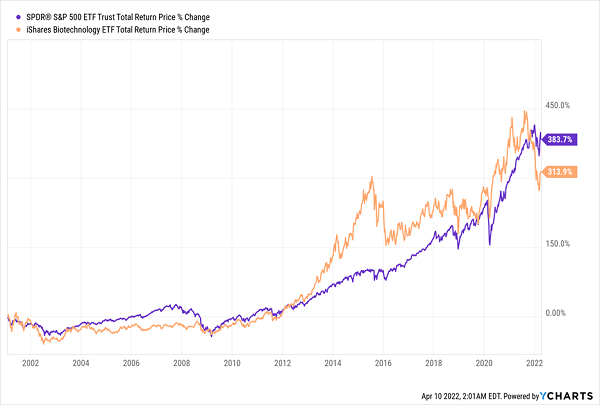

These days, healthcare is hands-down the most wrongly trashed corner of the market. The sector's drop in 2022, as shown below by the performance of the iShares Biotechnology ETF (IBB), is a terrific opportunity for us to fish for big payouts, especially since IBB has outrun the S&P 500 over the long haul:

But CEF fans that we are, we'll take a pass on IBB and its microscopic 0.45% yield. Instead, we're going to look at four healthcare-focused CEFs.

BlackRock needs no introduction: the mega-fund manager has over $10 trillion of assets in its care and two healthcare CEFs worth a look: the BlackRock Health Sciences Trust (BME), which yields 5.6%, and the 9%-paying BlackRock Health Sciences II Trust (BMEZ).

Since BMEZ's IPO in 2020, it has delivered a total return similar to that of IBB, but with a much bigger share of that return in cash. BME has performed better, with the tradeoff being a smaller, but still generous, 5.6% yield. It's worth noting, too, that both funds pay dividends monthly, so their payouts nicely line up with your bills.

What about their portfolios? BME's top holdings are conservative and include insurer UnitedHealth Group (UNH), diagnostic-equipment maker Thermo Fisher Scientific (TMO) and drug maker Abbott Laboratories (ABT).

BMEZ, for its part, counts cancer-treatment producer Seagen (SGEN), vision-care firm Alcon (ALC) and Masimo (MASI), a diversified maker of patient-monitoring systems, among its top investments.

Note that BMEZ's picks are all smaller firms with growth potential — but also a bit more risk. The market is compensating you for those risks, though, since BMEZ trades at a 13% discount to NAV, versus BME's 1% premium.

To diversify further within healthcare, consider the Tekla World Healthcare Fund (THW), with a 9.1% yield, and the Tekla Healthcare Opportunities Fund (THQ), which yields 5.9%. Both of these funds pay monthly, too.

Both focus on larger firms from across the healthcare ecosystem. Top holdings for THQ include UnitedHealthGroup, Johnson & Johnson (JNJ), Thermo Fisher Scientific, Abbott Laboratories and AbbVie (ABBV); THW has a similar composition, with UnitedHealthGroup and Thermo Fisher among its top-10 holdings, as well as Roche Holding (RHHBY), Pfizer (PFE) and AstraZeneca (AZN).

THW is the more international fund of this pair, with a quarter of its assets outside the US, while THQ only holds about 2% of its portfolio abroad. So a mix of both would get you a well-diversified set of holdings and a nice income stream, plus plenty of gain potential.