It is hotly debated whether or not the U.S. housing market is in a bubble today, cautions Jim Stack, a safety-first focused money manager, a noted market historican and the editor of InvesTech Research.

This is of extreme importance not only to the housing sector, but also financial markets given the importance of housing to consumers’ net worth and the resulting wealth effect.

When this run-up in U.S. housing prices over the past decade — and particularly over the past two years — is overlaid on top of the 2005 Housing Bubble, along with Japan’s equally painful 1991 Housing Bubble, the comparison seems ominous.

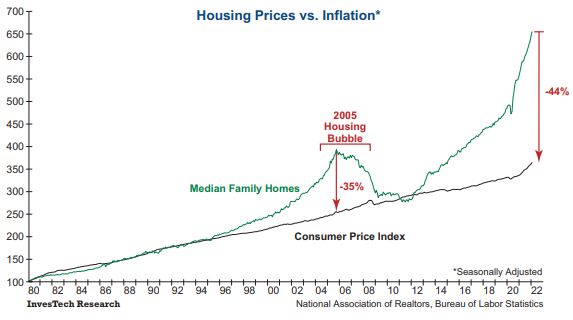

One of the most conclusive pieces of evidence showing the housing market was in a bubble during the early 2000s was the significant and growing disconnect between Median Family Home prices and the Consumer Price Index (CPI).

While prices did ultimately fall back to meet the CPI over the next seven years, a decade of overly accommodative Federal Reserve policy has once again led to housing prices significantly diverging from CPI (see graph below).

Today’s divergence, however, is even greater than it was at the peak of the housing bubble in 2005, as prices would now need to fall -44% from here to return to the broader inflationary trend.

Another indicator which showed the "bubblish extremes" of the housing market in 2005 was the U.S. House Price-to-Rent Ratio from the OECD. This measures whether home prices are moving in or out of step with rental prices.

When home prices are rising far faster than rents, as they are today, it typically indicates that speculation is causing home prices to rise beyond what is justified by the underlying fundamentals.

Together, today’s extreme home prices and sudden jump in mortgage rates have created a perfect storm for the housing market outlook in 2022, and any prospective buyers hoping to step into their first home. Homeowners’ mortgage payments relative to income is now at the highest level in over a decade, and not far from what was experienced at the peak of the housing bubble in 2005.

To be clear, this is not an exact replica of the 2005 Housing Bubble, which was caused by subprime lending. Rather, today’s bubble was created by ultra-accommodative monetary policy and now poses interest rate and affordability risk.

The evidence of a housing bubble is now compelling, and risks are clearly rising. If (or rather when) the bubble pops it will have far-reaching impact on the economy.

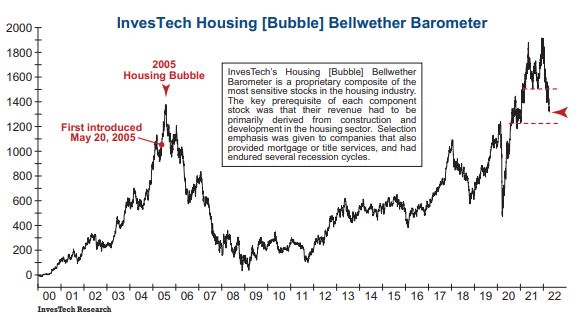

One indicator to watch is our InvesTech Housing [Bubble] Bellwether Barometer, featured in the chart below. We created this indicator to track the bubble in housing-related stocks in May 2005, and soon thereafter it gave a reliable warning flag by turning lower three months ahead of the peak in home prices.

This barometer had another impressive run following the COVID-19 Crash in 2020, fueled by the Federal Reserve cutting interest rates to zero and purchasing over $1 trillion in mortgage-backed securities.

However, this indicator came under pressure at the end of last year and broke under its initial support level in February. It continues to show weakness and is now threatening to break under long-term support. Should this key level fall, it would further confirm the peak in the housing market is at hand.

Many economists and market pundits will argue that housing is one of the strongest segments in today’s economy. And while soaring home prices are depressing to those prospective buyers searching for their first home, at least existing homeowners are feeling confident about their rising equity or net worth — for now.

Today’s highly inflated home prices and rapidly rising mortgage rates make housing the potential “Achilles heel” to the U.S. economy if prices and construction start to head south.

Our model fund portfolio continues to have a net invested allocation of 58% with defensive positioning. It takes discipline and patience to be a risk manager.

Our goal is to proactively manage risk through this period of uncertainty while seeking out defensive investment opportunities. In the meantime, investors should step softly and carry a comfortable cash reserve until the next great buying opportunity arrives.