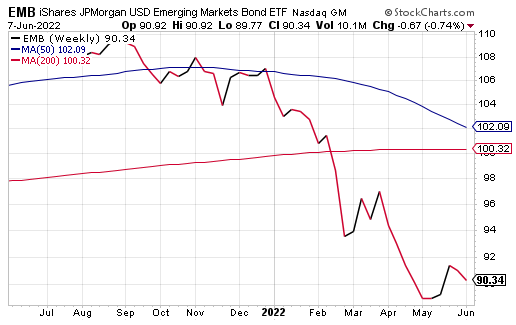

The iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB) seeks to track an index of U.S. dollar-denominated, sovereign debt issued by emerging-market countries, notes Jim Woods, exchange-traded fund specialist and editor of The Deep Woods.

EMB, one of the first emerging-market debt ETFs to be launched, tends to own strong assets and offer consistent liquidity. It is like many peer funds, but EMB is U.S.-dollar-denominated rather using local-currency debt.

This eliminates direct currency risk for U.S. investors but increases credit risk that a strengthening dollar or weakening local currency could make the debt harder to service.

Each issuer must have at least $1 billion outstanding, and bonds need a minimum of two years remaining to maturity. The fund typically favors longer maturities and tends to lean toward riskier paper, both of which increase yield. One of EMB’s strongest selling points is its strong liquidity, enhancing its appeal for traders.

Source: www.stockcharts.com

EMB has $15 billion in assets under management and a 0.01% average spread. It has 614 holdings and an expense ratio of 0.39%, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds.

The fund will invest at least 80% of its assets in the component securities of the underlying index and will invest at least 90% of its assets in fixed income securities of the types included in the underlying index. The index is a broad, diverse U.S.-dollar-denominated emerging markets debt benchmark that tracks the total return of actively traded, external debt instruments in emerging market countries.

iShares J.P. Morgan USD Emerging Markets Bond ETF provides exposure to U.S. dollar-denominated government bonds issued by emerging market countries, access to the sovereign debt of 30+ emerging market countries in a single fund, a potentially superior yield to its peers and emerging markets allocation.

However, as with any opportunity, potential investors should conduct their own due diligence in deciding whether or not this fund fits their own individual investing needs and portfolio goals.