Along with the other precious metals, palladium has taken a bruising in recent months as a weakening global economy, combined with continued coronavirus-related restrictions in China, have diminished the metal’s demand profile, observes Clif Droke, editor of Cabot SX Gold & Metals Advisor.

And while those factors haven’t improved much, there are reasons to believe that palladium prices could be at an important juncture. Consider, for example, that palladium’s biggest supplier — Russia — is still engaged in its war with Ukraine. This has created a tight global supply situation for the metal due to delivery disruptions.

Then there’s Russian oligarch Vladimir Potanin, the country’s second-richest man who, according to Reuters, has been purchasing assets from firms exiting Russia over the war.

Known as Russia’s “Nickel King,” Potanin was among the latest group of financiers to be sanctioned by Britain over the war. Potanin also happens to own a 36% stake in Nornickel, the world’s largest palladium producer.

On the futures front, CFTC data show that commercial hedgers (a.k.a. the “smart money”) have recently reached their least hedged position in palladium of the last 10 years. With the commercials heavily exiting short positions, the possibility for a worthwhile short-covering rally has increased.

Given how technically “oversold” the palladium market has become in recent weeks, I see a long trade in the catalyst metal as being asymmetric at this time.

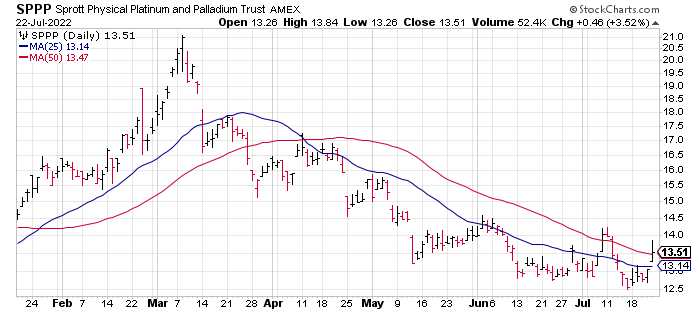

The Sprott Physical Platinum & Palladium Trust (SPPP) is arguably the lowest-cost way to play a potential palladium market short-covering rally. As mentioned above, I view this as an asymmetric trading opportunity given the strong short-covering trend among commercial hedgers in the palladium market.

However, because this ETF is coming off a major low and doesn’t enjoy the tailwind of forward momentum (as most of my recommendations do), it also represents an above-normal volatility risk.

For that reason, I’m not recommending this trade for conservative traders. That said, participants who don’t mind the risk can purchase a small position in SPPP here using a level slightly under $12.60 as an initial stop-loss (closing basis).