If I asked you to tell me the top-performing sector of this very tough 2022, I suspect you’d easily come up with energy — and you would be correct, notes Jim Woods, editor of High Velocity Options.

Stocks in the oil and gas sector have bucked the bearish trend, as the smart money has rightly gravitated toward the segment that is benefiting from high inflation, geopolitically induced scarcity and still-robust demand.

Those ingredients continue to push stalwart stocks in the space higher, and one such stock and its call options are what we are embracing as our latest portfolio addition. That stock is ConocoPhillips (COP), the U.S.-based independent exploration and production firm.

In 2021, COP produced 1 million barrels per day of oil and natural gas liquids and 3.2 billion cubic feet per day of natural gas, primarily from Alaska and the lower 48 states in the United States, Norway in Europe and several countries in the Asia-Pacific region and the Middle East. Proven reserves at year-end 2021 were 6.1 billion barrels of oil equivalent.

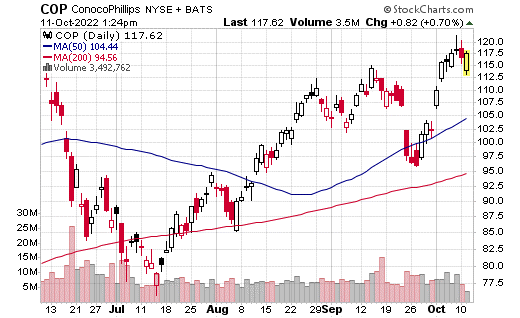

COP has seen its share price power higher by nearly 57% over the past 52 weeks, a performance that puts it firmly in the top 2% of all stocks on a relative strength basis. Earnings per share (EPS) growth also is stellar, with EPS growth in the top 19% of all firms over the past several quarters and several years.

The most attractive part of COP here is its technical pattern. Shares have been forming a bullish cup-with-handle pattern since late August, and over the past couple of sessions, the stock has broken out to a new 52-week high.

I suspect this trend higher will continue, and that the fundamentals will result in a strong earnings report when the company releases results on November 3.

So, let’s take advantage of what I suspect will be a continuation of this bullish trend with the following call options position: buy the ConocoPhillips December $125.00 call options.