Recent remarks from Fed Chair Powell essentially confirmed that the FOMC will be slowing the pace of rate rises — the conventional wisdom being that December will feature a 50-basis-point hike rather than another consecutive 75-basis-point hike, observes Monty Guild in Guild Investment Management's Market Commentary.

In response, the NASDAQ led a broad rally that also saw the S&P 500 peek above its 200-day moving average for the first time since April. In the end, Mr Powell’s remarks are a slender reed on which to hang a rally.

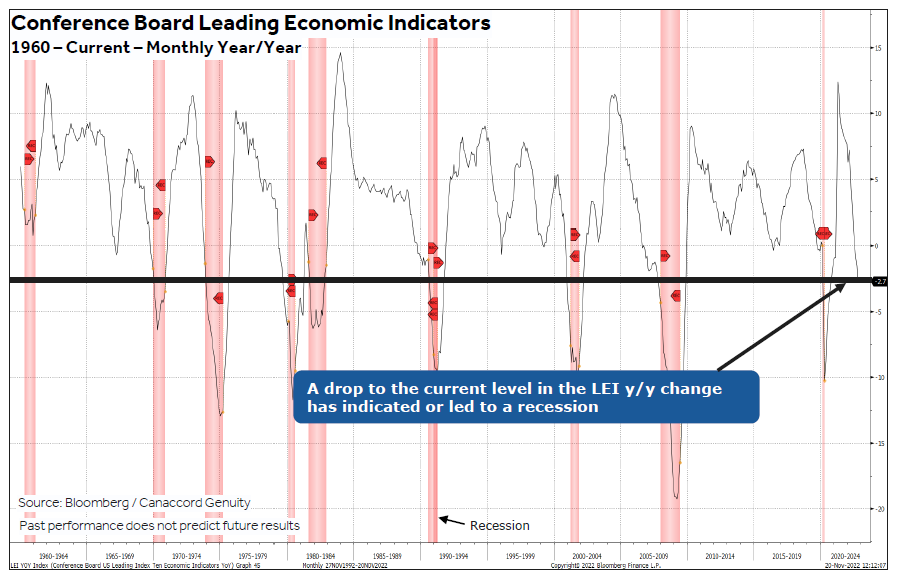

We caution that several broader readings of the deceleration of leading economic indicators continue to suggest very strongly that a recession of uncertain severity is in the cards for 2023.

Source: Canaccord Genuity

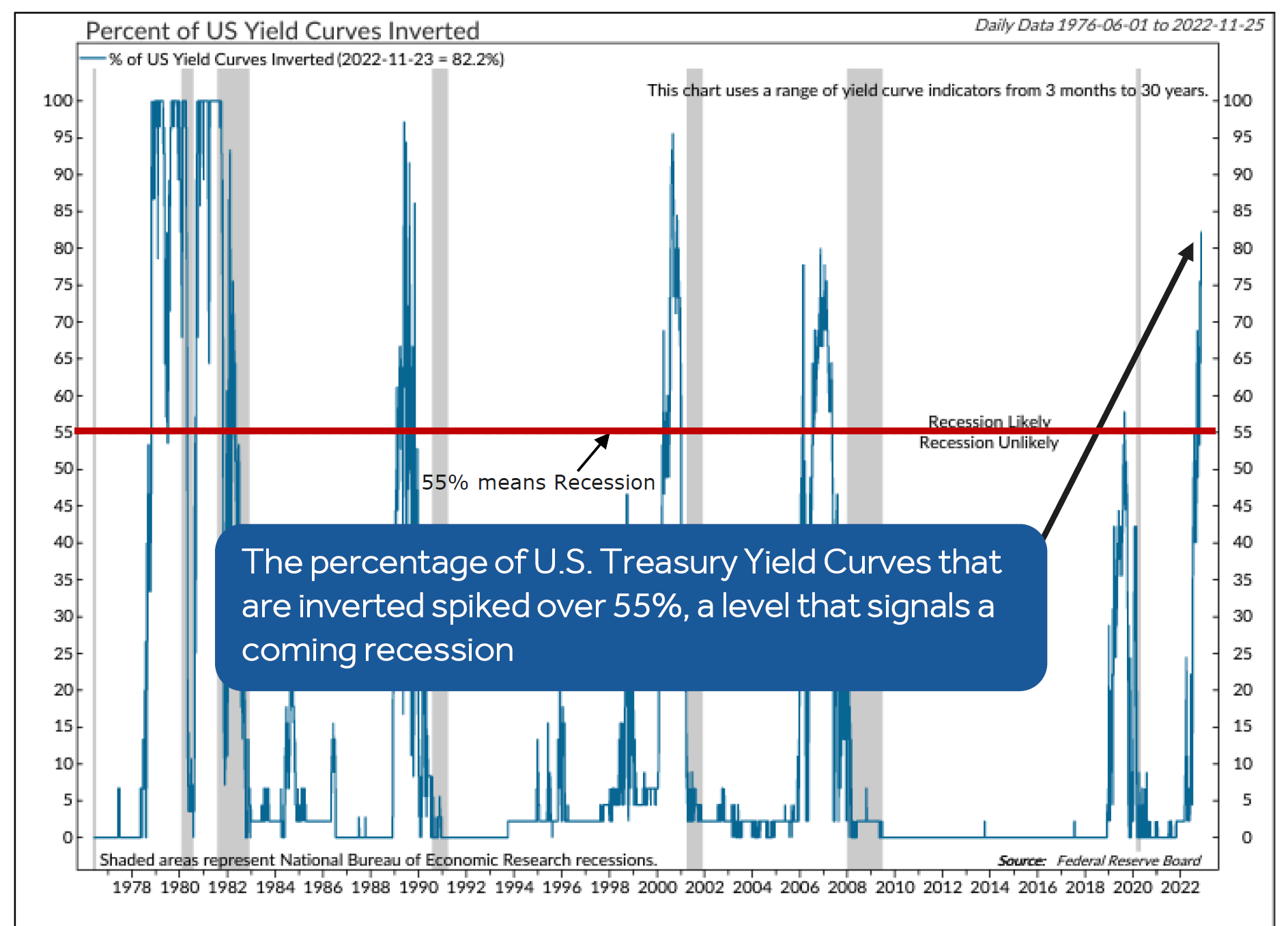

A further strong harbinger of recession is of course yield-curve inversion: that is, longer-term interest rates dropping below nearer-term interest rates, the opposite of a normal non-recession structure.

There are many different ways to examine this by comparing various short and long-term rates; however, now, the proportion of these yield-curve pairs that are inverted suggests strongly that a recession lies ahead and the U.S. economy will not be experiencing a “soft landing.”

Source: Canaccord Genuity

The approach of recession is corroborated by a number of other factors as well, including the continued rapid decline of M2 money growth into negative levels not seen since the 1970s. If the recession hypothesis is incorrect, much of what follows will be incorrect; but we believe the data favor the recession hypothesis strongly.

Of course, the arrival of an economic recession has overwhelming significance for the direction of corporate earnings, which as our readers have heard us say ad nauseam, are the mother’s milk of stock prices.

Thus far, the median S&P 500 stock has only baked in a 3.6% adjustment to anticipated 2023 earnings. That is, the correction as it has unfolded this year has likely incorporated only multiple compression from rising interest rates, and not the earnings decline that would accompany a recession.

Part of the reason that some analysts are projecting a somewhat severe earnings slump is wage inflation and margin deterioration, which historically has played a large role in the magnitude of earnings decline.

And while inflation is indeed moderating quickly from the peaks earlier this year, it promises to remain elevated, in comparison with recent history — which will likely mean continued pervasive wage pressures, even with moderating labor market tightness. The Guild Basic Needs Index, our in-house real-world inflation gauge, continues to show this deceleration.

All of this is to say that while a relief rally may well continue through the end of the year, we are cautious as we look forward to 2023. We believe that some tactical trading may be warranted for the remainder of the year, and we might take advantage of some year-end tax-loss selling to buy certain deeply punished stocks that we believe represent value longer-term. But for high-conviction deployment of assets, we would wait for a deeper correction to come in 2023 as the earnings recession runs its course.

All of this is to say that while a relief rally may well continue through the end of the year, we are cautious as we look forward to 2023. We believe that some tactical trading may be warranted for the remainder of the year, and we might take advantage of some year-end tax-loss selling to buy certain deeply punished stocks that we believe represent value longer-term. But for high-conviction deployment of assets, we would wait for a deeper correction to come in 2023 as the earnings recession runs its course.

Thus far, on a sector and industry level, the most punished stocks are predictably, consumer durables and apparel, automobiles, media and entertainment, semiconductors, and transportation. The only sector that has shown positive earnings revisions is energy.

To sum up, in our view, it remains an appropriate time for careful tactical trading, and for waiting patiently for better opportunities to arrive. We are not yet at a “washout” moment, in spite of the painful year that we’ve almost finished, but that washout is drawing closer.

Subscribe to Guild Investment Management's market Commentary...