Small-cap stocks are not to be overlooked, especially when they are packed into an exchange-traded fund (ETF) that works differently than others, suggests Jim Woods, editor of The Deep Woods.

This particular ETF is Pacer US Small Cap Cash Cows 100 ETF (CALF). CALF gives investors access to the U.S. small-cap arena, but its methodology is a bit different then other funds, since it focuses on free cash flow and how to use it to maximize returns.

Using the S&P Small Cap 600 Index, the ETF screens out financial companies, except for real estate investment trusts (REITs). The rest of the holdings are mostly consumer cyclicals.

After that first filtering process, CALF then ranks the remaining companies by their trailing 12-month free-cash-flow yield, takes the top 100 companies from that pool and weights them by their trailing free cash flow yield. The weighting for each of the companies within the ETF is capped at 2%.

CALF’s free-cash-flow strategy aims to provide long-term capital appreciation. Using free-cash-flow yield to measure the sustainability of a company may produce potentially higher returns and more appealing upside/downside capture over time.

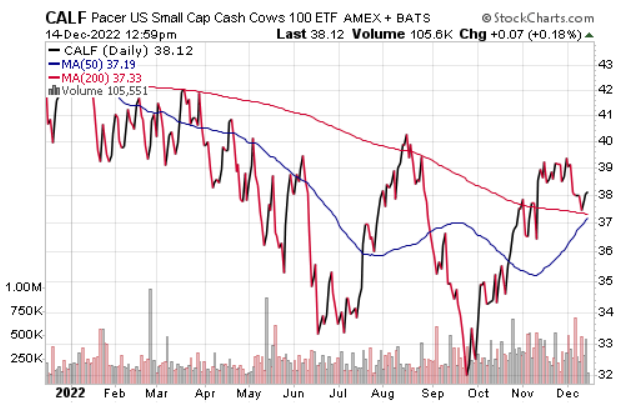

As you can see from the chart below, CALF has seen quite a bit of activity throughout the year. However, for each dip it has seen, it’s seen an equal or higher spike. The ETF plummeted in mid-September but within three months rebounded and is continuing to climb.

CALF has $1.41 billion in net assets and a 3.12% distribution yield. It is currently sitting comfortably near the high end of its 52-week range.

The fund’s top 10 holdings include Atlas Air Worldwide Holdings (AAWW), Sonic Automotive Inc. Class A (SAH), Academy Sports and Outdoors (ASO), Abercrombie & Fitch (ANF), Signet Jewelers (SIG), Meredith Corp. (MDP), AMC Networks (AMCX), Vir Biotechnology (VIR), Select Medical Holdings (SEM) and Mueller Industries (MLI).

CALF is a unique ETF with a focus on small-cap stocks that generate high free cash flow. Further, the fund offers investors exposure to opportunities in the market where high-quality stocks are trading at a discount.

While CALF does provide an investor with a way to invest in small-cap stocks, using a unique strategy, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.