We’re facing another year of gloominess in 2023; we don’t want to get caught in a possible downdraft, but we also want the exposure for another possible decade of 13% annualized gains, explains Michael Foster, investment strategist with Contrarian Outlook.

And perhaps most important, we want to keep a high dividend stream coming in, even if the permabears win and the market’s eventual recovery takes more than a few months.

This is where closed-end funds (CEFs) come in. They’re a group of high-yielding funds that offer higher yields than pretty well any ETF: the average CEF yields 7.2%, with many high-quality funds yielding more. And these days, many CEFs trade at steep, and highly abnormal, discounts to NAV, so we’re getting their holdings for less than their true market value.

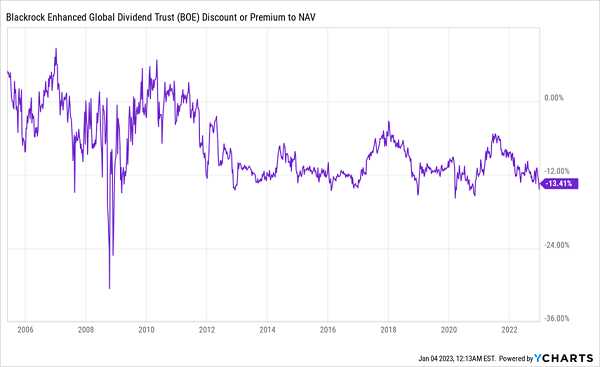

Take, for instance, the BlackRock Enhanced Global Dividend Trust (BOE), a 7.9% yielder that pays dividends every month. It holds many global value stocks boasting strong cash flows, such as Sanofi SA (SNY), AstraZeneca PLC (AZN) and Unilever PLC (UL). Not only is BOE trading at a deep discount now — it’s also near the bottom of a repetitive “discount cycle” we can take advantage of:

As you can see in the chart below, demand for the fund is cyclical, with the discount rising and falling in clear waves. We’re currently at the trough of the latest wave, with the crest due in perhaps two years. But the crest has also been coming faster as BOE’s cycles get shorter.

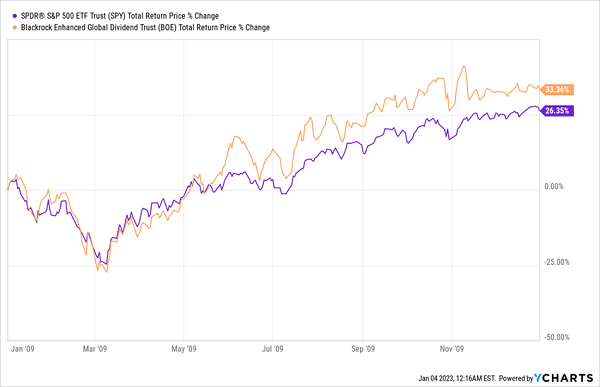

My estimate: just on its closing discount alone, BOE could see double-digit gains, on top of its near 8% yield. And that doesn’t include appreciation in the fund’s portfolio, which would drive its market price higher still. We saw this same dynamic unfold back in ’09, and BOE beat the broader market.

If 2023 turns out to be another 2009, equity CEFs, including BOE, will take off as their discounts close and their high dividends draw in more income-focused investors. That would make now a good time to make a contrarian buy.