The year 2022 will go down in history for many things, but the most important will prove to be the breakout rise in long-term U.S. treasury yields. The new trend means higher rates for longer, and higher inflation for longer, despite conventional wisdom, asserts analyst Omar Ayales, editor of Gold Charts R US.

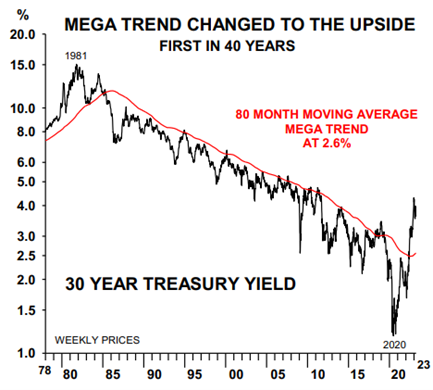

The breakout rise is putting an end to a secular bull market that has lasted over 40 years, specifically since 1981, the year long term rates on U.S. Treasury notes peaked at about 15%.

This doesn’t mean interest rates won’t fall or pull back. However, as long as the yield on a 30-year U.S. Treasury holds above 2.60%, it’ll remain within its secular bullish uptrend that could last years, if not decades.

On the chart, note the U.S. 30-year yield since the peak in 1981 and the ensuing secular bear market that bottomed just last year. Notice the yield rising above secular resistance at the red line. The chart shows a clear breakout rise, suggesting the 30-year yield may have entered into a secular bull market.

Higher yields mean higher inflationary forces that many are arguing cannot be sustained as the U.S. economy is about to go into a recession as the lag effects of tight monetary policy seep into the real economy. But although the U.S. economy might be cooling off, a strong labor market suggests the economy will remain hotter than many anticipate, keeping strong pressure on global demand for resources and energy. The recent jobs data released confirms economic resilience.

Moreover, despite the Federal Reserve’s strongest efforts, the available money supply in the U.S. remains heavily above its organic trend, which means excess liquidity remains trapped in the system. That could contribute to the velocity of money as traders and investors look for higher yields in the current inflationary environment.

Recommended actions: The higher rates for longer will change the way we invest. We must incorporate into our portfolios more gold, silver, resources, energy…commodities overall. It’s time to bet on emerging markets, too. They’re due.