Russia’s invasion of Ukraine has helped push agricultural commodity prices higher. The Invesco DB Agriculture Fund (DBA) is one way to gain exposure to that trend, writes Paul Dykewicz, editor of StockInvestor.com.

We have highlighted five agricultural investments investors can purchase to hedge against Russia’s raging war in Ukraine. They include an industry fund, the world’s largest farm equipment manufacturer, a tractor supply company, a fertilizer business, and a potato grower.

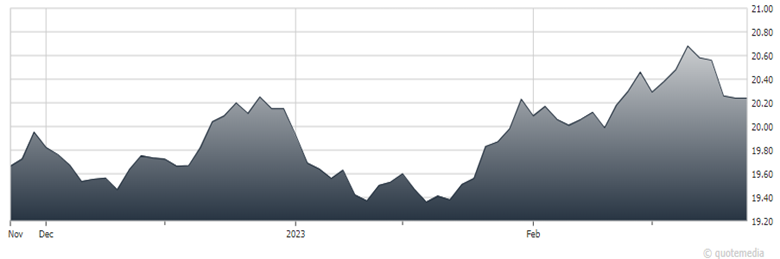

Today, let’s talk about DBA. Investors seeking exposure to agricultural price trends can invest in diversified industry commodities through this ETF. It seeks to track changes in the DBIQ Diversified Agriculture Index Excess Return. The fund earns interest income from cash it invests primarily in U.S. Treasury securities, as well as money market investments, while holding them as collateral for the futures contracts.

The fund is designed for investors who seek a cost-effective and convenient way to invest in commodity futures. The Index is rules-based and composed of futures contracts on some of the most liquid and widely traded agricultural commodities. DBA and the Index are rebalanced and reconstituted annually in November.

Invesco DB Agriculture Fund (DBA)

Top holdings and percentages of the fund were recently as follows: Sugar, 13.4%; live cattle, 12.63%; coffee, 12.23%; soybeans, 12.16%; corn, 11.77%; cocoa, 11.68%; and wheat, 11.29%. The fund’s total expense ratio is 0.91%, and its share price had recently risen slightly so far in 2023.

Russia’s threatening rhetoric and military actions against Ukraine, and the decimation of the latter nation’s role as a provider of precious grain to Europe and other regions of the world, are supporting commodity prices. Before its assault, Ukraine had been one of the world’s largest grain producers, according to the United Nations Food and Agriculture Organization. Ukraine provided for nearly 15% of global exports of wheat, maize and barley in 2021, while also exporting 6% of all food calories globally.

Investing in DBA helps hedge against those impacts. It’s also worth noting we just passed the 1-year anniversary of Russia’s Ukraine invasion – with no end in sight to the conflict.

Recommended Action: Buy DBA.