NextEra Energy Partners (NEP) is a “yieldco” company that owns renewable energy production assets with the output sold on long-term contracts, and it features a high dividend growth rate, educates Tim Plaehn, editor of Monthly Dividend Multiplier.

Large-cap ($150 billion market cap) public utility NextEra Energy (NEE) is the sponsor company of NextEra Energy Partners. As the sponsor, NEE will develop or acquire renewable energy assets, which are then sold to NEP at prices that allow the NEP dividend rate to continue growing. NextEra Energy has been highly supportive of NextEra Energy Partners investors and the company’s prospects to sustain its dividend growth goals.

NextEra Energy Partners was launched with a June 2014 IPO. The stock has generated a total return of more than 280% for those investors who got in at the $25 IPO price. But don’t worry that you missed out on those gains — there is still plenty of upside for attractive future returns.

Currently, the company owns 8,300 megawatts (MW) of renewable energy production assets and 4.3 billion cubic feet (Bcf) of natural gas pipeline capacity. While NextEra Energy is primarily a Florida-based utility, the NEP assets are in the western two-thirds of the U.S.

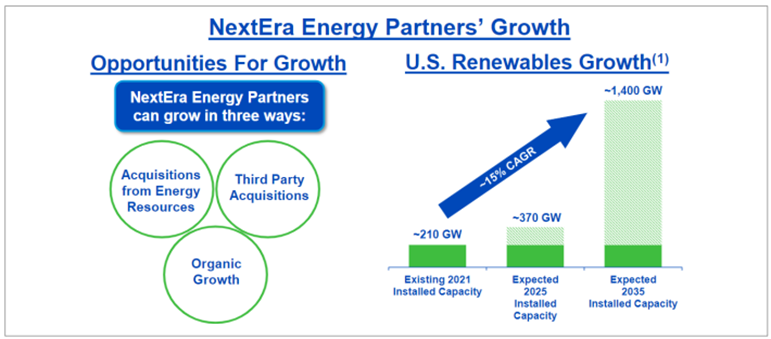

Growth for NextEra Energy Partners requires acquisitions. The company has a three-pronged strategy to find new assets for acquisition. This graphic shows the company’s source of new assets to acquire, and thus keep growing, the company’s revenue, cash available for distribution, and dividend.

“Energy Resources,” mentioned in the leftmost of the three circles above, is a division of NextEra Energy that owns production assets focusing on being the leading North American clean energy company. The company has 24 GW of power generation in operation. The Energy Resources assets are available to be purchased by NextEra Energy Partners. Periodic investments by NEP out of the Energy Resources portfolio will ensure the yieldco can continue to grow its dividend.

Last year, NextEra Energy announced that it would cap the incentive distribution rights (IDRs) paid by NEP at $157 million per year. This expense reduction for NEP means incremental free cash flow will be 100% available to grow distributions paid to common unit investors — that’s us!

NextEra management has provided 12% to 15% distribution growth guidance through 2026. NEP has a history of exceeding its dividend growth guidance.

At the June 2022 Investor Conference, NEE management increased its earnings per share expectations through 2025 by 6%, to 8%. NEP recently yielded 4.5%, which means if the dividend growth targets are met, this stock should generate our target mid-teen or higher average annual total returns.

Recommended Action: Buy NEP.