DaVita (DVA) is the nation’s largest provider of care for individuals with kidney disease. It currently trades at historically low valuations, but we think the reasons are transitory. Combined with strong growth prospects, that suggests potential for major outperformance, writes Stephen Leeb, editor of The Complete Investor.

Through its treatments, DaVita directly addresses a major problem, exorbitant U.S. health care costs. An estimated 15% of adults here suffer from chronic kidney disease (CKD), yet only about 10% of them are aware they have the disease. More alarming, only around 40% of those with severe CKD understand the reason for the many debilitating symptoms they are experiencing.

Severe CKD makes people more prone to numerous other health problems, including infections resulting from a weakened immune system; cardiovascular disease; and psychological problems including depression. Kidney disease, including hypertension directly related to kidney failure, is the ninth leading cause of death in the U.S.

DaVita treats patients with severe chronic kidney disease, often referred to as end-stage renal disease (ESRD). The most common treatment for ESRD is dialysis, a process that cleans blood of the wastes resulting from poorly functioning kidneys. Many dialysis patients can live relatively normal lives, if they receive proper care. DaVita has a nearly 40% share of the U.S. dialysis market, generating about 90% of companywide revenues.

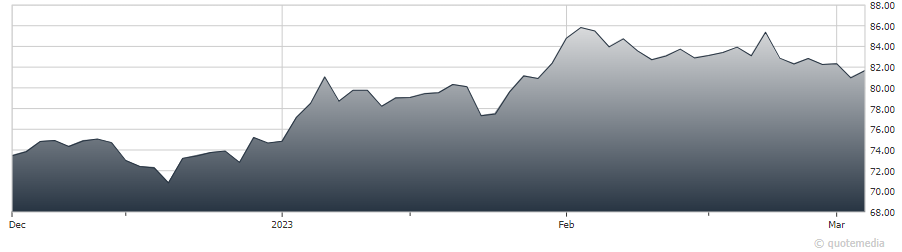

DaVita (DVA)

Dialysis encompasses a multitude of different approaches. There are two types: hemodialysis (HD) and peritoneal dialysis (PD). The procedure can occur at home or in one the company’s dialysis centers or in a hospital. The key variable in kidney care is how much dialysis a patient requires. More dialysis is associated with higher cost, greater mortality, and a less fulfilling life.

DaVita’s patients, thanks to the company’s heavy investments in technology and its close association with government-sponsored agencies, require significantly less dialysis than patients of competing providers. Thus, they fare better on all three scores. It’s consistent with the company’s very low pay-differential ratios, and it doesn’t surprise us that DaVita employees are referred to as “teammates.”

An aging U.S. population, greater awareness of untreated kidney disease, and growth in international markets are powerful arguments for long-term growth for the company. Analysts have been misled by the pandemic’s lingering effects on patients seeking kidney care.

The lower-than-expected patient counts have led to profits that, while higher than pre-pandemic levels, have been below expectations. As a result, the stock is trading some 30% below its 12-month high. With long-term growth drivers getting stronger and an FCF yield of close to 15%, we think a bet on a strong recovery is one you should want to take.

Recommended Action: Buy DVA.