We’ve got a nice opportunity sitting in front of us in corporate bonds, which were more oversold than stocks last year. It’s the Western Asset High Income Opportunity Fund (HIO), a classic high-yield bond fund sporting a variety of issues that are mainly from bigger companies, contends Michael Foster, editor at CEF Insider.

It’s hard to believe the market and the Fed are still duking it out over where interest rates will top out—and how long they’ll stay there.

To be sure, there’s still a lot of uncertainty around rates. But here’s something we do know: As long as this battle lasts, there will be periods of volatility—including among CEFs—that we canny contrarians can take advantage of.

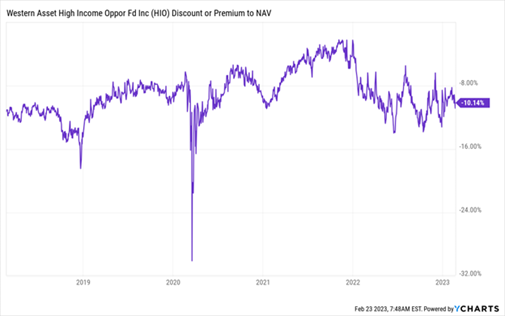

HIO is an example. It recently yielded 9.2% (with a payout that comes our way monthly) and boasted a 10.1% discount to net asset value (NAV), which is near the low end of its usual 5% to 12% range.

Here’s something else that makes HIO perfect for today: Unlike most CEFs, it doesn’t use leverage. Its returns (and dividends) are driven only by management’s picks. And the team at the top knows what it’s doing — they’re led by an understudy of the legendary “Bond King,” Bill Gross. Thanks to HIO’s meager fees, we get to “hire” this all-star portfolio manager for a song!

Now let’s talk about HIO’s portfolio. About 64% of HIO’s holdings are in the U.S., with bonds from the likes of Western Midstream Operating LP (natural gas processing and shipping), Delta Airlines and Occidental Petroleum. Developed nations in Europe make up most of the rest.

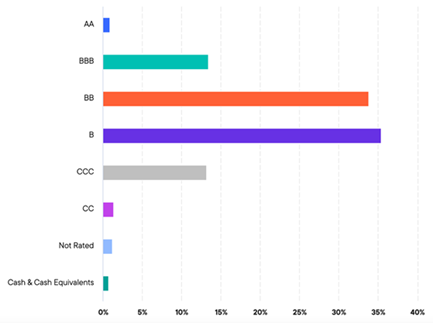

That’s left the fund with nearly 70% of its holdings in the BB or B categories: Risky enough to get us high yields, but not so risky as to expose us to default risk (which is low at any rate—only about 1.3% of corporate bonds end up defaulting, and even among those that do, holders usually get 80 cents on every dollar invested).

HIO's "Goldilocks" Credit Quality

Source: franklintempleton.com

Another reason to favor HIO now is the duration of its bonds, which is on the long side at 7.2 years. Long-duration bonds tend to struggle when rates rise, as newer bonds with higher yields compete for investor attention. But now that we’re likely near the end of the Fed’s rate-hike cycle, HIO’s managers can buy longer-duration bonds at attractive prices.

Recommended Action: Buy HIO up to $4.50