Merck & Co. (MRK) performed well in 4Q22. Adjusted EPS came to $1.62, above the consensus of $1.54 per share, and revenue came in at $13.83 billion, beating the consensus by $174 million. We are reiterating our BUY rating, writes Jasper Hellweg, analyst at Argus Research.

The results reflected 26% constant-currency sales growth for Keytruda, the company’s top-selling product, and 6% growth for Gardisil, its second-highest selling product. Merck continues to receive regulatory approvals for additional indications for its products, including a new approval for Keytruda in non-small cell lung cancer.

It also recently announced that the FDA granted breakthrough therapy designation to Keytruda in combination with an investigational personalized mRNA cancer vaccine co-developed with Moderna for the adjuvant treatment of patients with high-risk melanoma following complete resection.

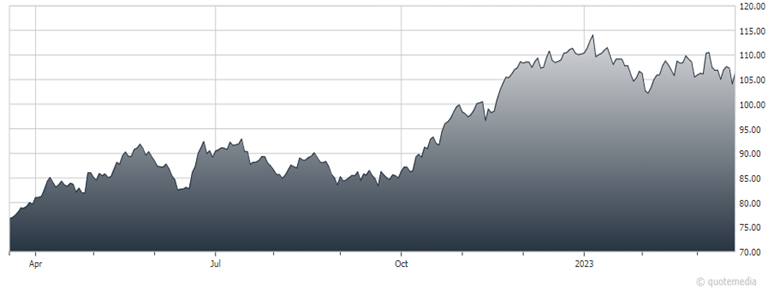

Our revised target price of $115, raised from $110, implies a total return, including the dividend, of roughly 11% from recent levels. The company generates strong cash flows from its portfolio of oncology, hospital care, and antiviral products.

Merck & Co. (MRK)

Merck is also on track to receive additional approvals for cardiovascular drugs by 2030, and recently completed a tender offer to acquire Imago Biosciences, Inc., a clinical stage biopharmaceutical company developing new medicines for the treatment of myeloproliferative neoplasms (MPNs) and other bone marrow diseases.

Meanwhile, our financial strength rating on Merck is Medium-High, the second-highest rank on our five-point scale. As of December 31, 2022, the company had cash and cash equivalents of $12.69 billion, up from $8.10 billion at the end of 2021. It had total debt of $31.99 billion, down from $34.63 billion at the end of 2021.

The debt/capital ratio was 41%, down from 48% and in line with the peer average. We view average levels as 50%-55%. The dividend is an annualized $2.92, for a recent yield of about 2.7%. Our dividend estimates are $2.92 for 2023 and $3.08 for 2024.

Recommended Action: Buy MRK.