For investors looking to find the next wave before it really gets going, Defiance Quantum ETF (QTUM) offers an investment that provides such an opportunity, elucidates Jim Woods, editor of The Deep Woods.

Investors are often interested in finding the “next big thing” before it becomes huge.

Successfully predicting the next trends in markets can potentially offer windfalls. Consider, for example, the results of investing in Alphabet (GOOGL) in 2004. Although an ETF might not produce massive results in the way a single company stock can, it could still be immensely profitable if one can determine what is coming.

One industry that could potentially blossom into something very important forms the thesis of the QTUM ETF. This exchange-traded fund invests in companies involved with quantum computing and machine learning.

Defiance Quantum ETF (QTUM)

These technologies have been finding profitable uses in recent years, and their importance only seems to be increasing thus far. The fund can hold companies involved in quantum computing development, application, interfacing with traditional computers and the supply chain, for creating materials such as semiconductors that are involved with quantum computing.

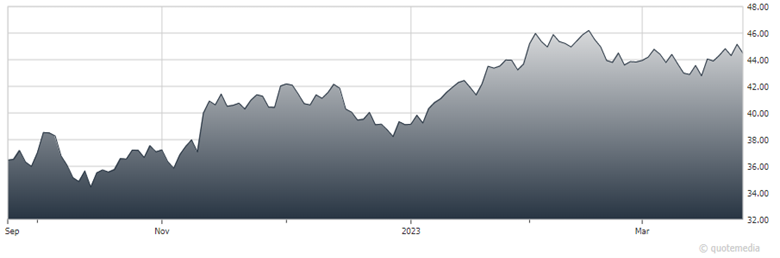

The fund’s holdings are equal-weighted, providing even exposure without regard for market cap. In the last year, QTUM is down 11.07%, which puts its performance close to that of the S&P 500, but, notably, above that of the tech-saturated Nasdaq.

Net assets of just $109 million make it a relatively small fund, but it offers enough liquidity to make it a viable investment vehicle. The fund offers a small yield of 1.30% and a middling expense ratio of 0.40%.

QTUM’s portfolio is primarily U.S.-based, but also offers some international exposure. About 60% of assets are invested in U.S. companies, with the remainder allocated to a variety of stocks based in countries that most prominently include Japan, Taiwan, China, France and the Netherlands.

Some notable names among QTUM’s holdings are NVIDIA Corp. (NVDA), Cirrus Logic (CRUS), Baidu Inc. (BIDU), Advanced Micro Devices (AMD) and Microsoft Corp. (MSFT), but there are plenty of non-household names in the portfolio as well.

Recommended Action: Buy QTUM.