Most of the breathless coverage about the fate of America’s banks is way off the mark. But it has created a CEF buying opportunity this month – the John Hancock Financial Opportunities Fund (BTO), explains Michael Foster, editor of CEF Insider.

Over the nearly three years we previously held this bank-focused fund, from late July 2018 to late June 2021, it did exactly what we want our holdings to do: Returned its dividend (and then some!), delivering a 6.4% average annual return (with dividends reinvested).

When we bought, BTO was yielding a lot less than it does today: just 3.9%. So, we got the dividend and another 50% or so of the payout in price gains. I’m expecting that and more again as the reporting around banks is revealed as too alarmist (not to mention incomplete).

The fund’s basics are mostly the same now as they were back then: BTO is still managed by John Hancock; it’s still a relatively small fund, at $540.7 million in assets under management; and it’s still focused on banks and the financial sector.

BTO’s former head, Lisa A. Welch, has since retired. But the new portfolio managers, Susan A. Curry and Ryan P. Lentell, both worked with Welch for years before she left. It’s hard to imagine she hasn’t taught her former employees all they needed to know to find the most undervalued banks with the strongest prospects. Especially since many of the current issues can be bypassed by simply avoiding banks focused on tech.

Indeed, BTO is perfectly positioned to get us into the most oversold bank bargains while cutting our risk. BTO has never held either SVB or Signature Bank, the banks that recently failed. Its current 179 bank holdings are conservative and diversified.

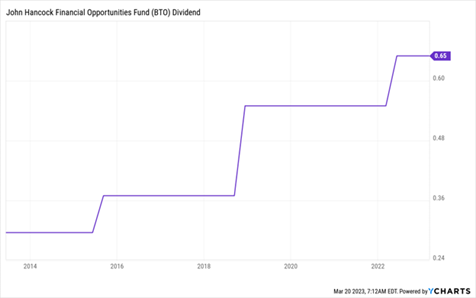

When we buy BTO today, we get all of its oversold banks and collect the fund’s 8.4% income stream and wait to sell it back when bank stocks rebound. This dividend is particularly sustainable now that bank stocks are beaten up, meaning getting more than an 8.4% annualized return on net asset value (NAV, or the value of BTO’s underlying portfolio) in the medium term to sustain dividends should be in the bag.

Recommended Action: Buy BTO.