My goal – whether I’m coaching you in my book Get Rich with Dividends or making recommendations in my newsletter – is to help you generate enough passive income from dividends that you never have to worry about money again. Here’s how you can get to that point, writes Marc Lichtenfeld, Chief Income Strategist at Wealthy Retirement.

Obviously, a lot will have to do with your lifestyle. But the longer you invest, the more your money will grow.

The key is to own Perpetual Dividend Raisers. These are stocks that raise their dividends every year. And you want to own the ones that raise their dividends by a meaningful amount so the increases are at least keeping up with inflation.

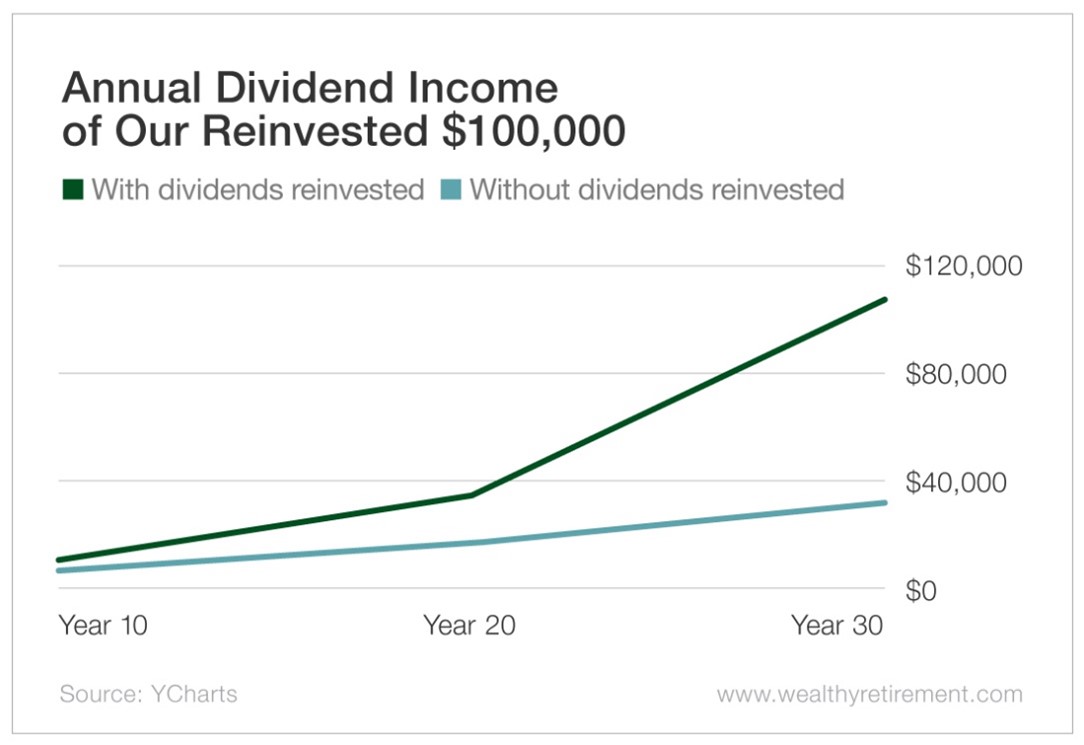

If you invest $100,000 in a portfolio with a starting yield of 4%, dividends growing at an 8% annual clip and stocks performing in line with the S&P 500 historical average, after 10 years, your investment is worth $229,032 and you’re earning $7,996 annually in dividends.

After 20 years, your nest egg is worth $524,559 and your annual dividends are $17,262. With a 30-year time horizon, you’re looking at $1,201,414, which generates $37,269 in annual dividends.

Now watch what happens if you reinvest your dividends. If you don’t need the cash spun off by these stocks yet, you can automatically reinvest the dividends. You just tell your broker that’s what you want to do. It’s very simple.

When you reinvest the dividends, you automatically buy more stock with the dividends (nothing out of pocket). You buy more shares and generate more dividends to buy more shares and generate even more dividends…

After 10 years of reinvesting, instead of the solid $229,032 producing $7,996 in annual dividends, you have $334,911 that’s spinning off $11,588. At the 20-year mark, you have $1,097,596 in your account, nearly double the $524,559 you’d have if you didn’t reinvest. And the income generated totals $35,824, which is more than double the $17,262 in the earlier example.

At 30 years of reinvesting, you’re sitting on $3,524,108, nearly triple the $1,201,414 you would have if you didn’t reinvest. And you’re collecting $107,572 per year in dividends – on an original investment of $100,000.

The best part about living off your dividends is never having to touch the principal since your nest egg spins off enough income every year to live on.

P.S. For those of you who are anxious to get started with Perpetual Dividend Raisers, the third edition of my book Get Rich with Dividends is now available on Amazon. Check it out!