In the wake of the Silicon Valley Bank et. al. failures, Wall Street sentiment has turned from mere “doom and gloom” to outright “apocalyptic.” Retail investors are also fearful, as they always are when stocks are cheap. That means it’s time to buy another name: Freeport McMoRan (FCX), argues Michael Murphy, Editor of New World Investor.

Why FCX? I’ve been researching different potential commodity investments and one really stands out. There is a MASSIVE supply/demand imbalance in copper that creates one of the most asymmetric bets I have ever seen.

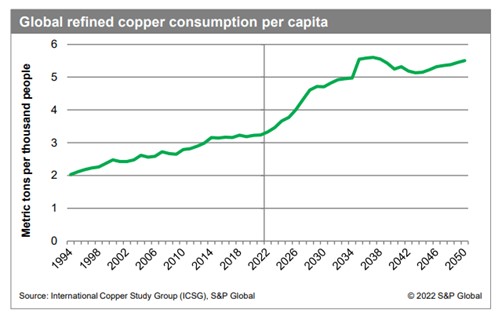

We are obsessed with electrifying the world – EVs especially, but also renewable electricity generation, electric stoves, power infrastructure, etc. That creates huge demand for copper, the “metal of electrification.”

EVs require 2.5x more copper than internal combustion engines. Battery packs are responsible for 90% of the copper demand in larger vehicles, like semis. Charging stations, harnesses, capacitors, electric motors – all require copper.

In July 2022, the IHS Markit division of S&P Global published The Future of Copper, subtitled “Will the looming supply gap short-circuit the energy transition?” They concluded that annual demand for copper will double by 2035 from 25 million metric tons (MMt) today to 50 MMt, with extra supply nowhere in sight.

That’s the long term. In the short term, inventories of copper are critically low, which means higher metal and stock prices are immediately ahead.

FCX is a Phoenix-based miner of copper, gold, molybdenum, silver, and other metals in North America, South America, and Indonesia. The company’s assets include the Grasberg minerals district in Indonesia; Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona; Tyrone and Chino in New Mexico; Henderson and Climax in Colorado; Cerro Verde in Peru, and El Abra in Chile. It also operates a portfolio of oil and gas properties primarily located in offshore California and the Gulf of Mexico.

FCX is America’s biggest copper supplier and one of the biggest copper producers worldwide. It’s also the world’s largest producer of molybdenum, a key element for every renewable energy tech you can think of, from wind and solar to nuclear energy, geothermal, wind, hydro and – you guessed it – EV batteries.

Freeport recently had a $59 billion market capitalization and traded at a 16.8x price/earnings ratio on trailing 12-month earnings. They’ll report their March quarter in a few weeks. Analysts are expecting revenues to fall 26.5% from last year to $4.85 billion with earnings down 62.6% to 40¢ a share.

Both earnings and guidance should surprise to the upside. In the last few years, Freeport slashed its net debt and tripled its dividend.

Recommended Action: Buy FCX under $44 for a $65 target within two years.