Gold traded briefly above $2,000 per ounce last week and now seems to be trading a bit more convincingly above that rounded number. Barrick Gold (GOLD), based in Toronto, is one of the world’s largest and highest-quality gold mining companies you can use to capitalize, explains Bruce Kaser, editor of Cabot Undervalued Stocks Advisor.

What’s behind the lift in gold? The yellow metal is generally thought to derive its value from its role as a safe haven in times of global fear and disruption. But we’re not entirely convinced of this, at least over the short term.

Our stronger view is that gold is primarily a store of value – a protector of buying power. When inflation is high (and perceived to be enduring), but interest rates aren’t keeping up, gold tends to surge. This was the case in the late 1970s, before the subsequent defeat of elevated inflation, combined with sliding interest rates, led to a sharp decline in gold prices.

Following its $260/ounce floor in 2001, gold then rose steadily over the following six years. Much of the latter era’s strength was likely due to the 35% decline in the value of the U.S. dollar, reflecting the use of dollars in executing gold transactions. The weak currency implies that gold would protect one’s buying power better than dollars, and hence it was bid up.

In any event, while it’s impossible to predict where gold prices are headed, we see the gold-favorable direction of the three key drivers (inflation, interest rates, and the dollar) as being reasonably sustainable.

Barrick offers investors a way to profit. About 50% of the company’s production comes from North America, with the balance from Africa/Middle East (32%) and Latin America/Asia Pacific (18%).

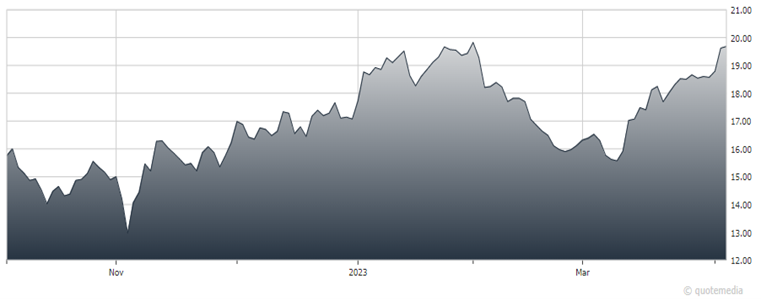

Barrick Gold (GOLD)

Barrick will continue to improve its operating performance (led by its highly capable CEO), generate strong free cash flow at current gold prices, and return much of that free cash flow to investors while making minor but sensible acquisitions.

Also, Barrick shares offer optionality. If the unusual economic and fiscal conditions drive up the price of gold, Barrick’s shares will rise with it. Given their attractive valuation, the shares don’t need this second (optionality) point to work. It just offers extra upside. Barrick’s balance sheet also has nearly zero debt net of cash.

Recommended Action: Buy GOLD with a $27 price target.