America is barreling down the road toward higher gasoline prices. I expect we could see $5/gallon gasoline this summer. To seize the profit opportunity that creates, look at the Energy Select Sector SPDR Fund (XLE), a basket of leading energy stocks, suggests Sean Brodrick, editor of Weiss Ratings Daily.

A week ago Sunday, OPEC+ — which includes the Organization of the Petroleum Exporting Countries plus a group of nations led by Russia — said it would reduce production by a further 1.15 million barrels per day beginning in May and lasting through the end of the year. OPEC slashed production targets by 2 million bpd in November.

More recently, Russia said it was extending a 500,000 bpd cut through the end of the year. Now, the total pledged output cuts by the group equal 3.66 million bpd — around 3.7% of global demand — and these are expected to remain in place until the end of the year.

To be sure, OPEC was nowhere near meeting its production targets anyway. In fact, even before the cuts were announced, OPEC’s production dropped 70,000 bpd in March. That’s a whopping 926,000 bpd short of the group production quota.

So, in effect, OPEC+ is cutting 117,000 bpd from current production. But that is happening when global oil demand is rising, as China emerges from its COVID-19 lockdown and buys a lot of oil. In fact, the International Energy Agency said last month it expects global oil demand to rise an additional 2 million bpd to 102 million bpd this year.

The combination of cuts and rising demand means production will fall short of supply. Stockpiles can make up for it in the short term. But by Q4 of this year, if nothing changes, production will be nearly 2 million bpd short of demand.

So, let’s talk about XLE...

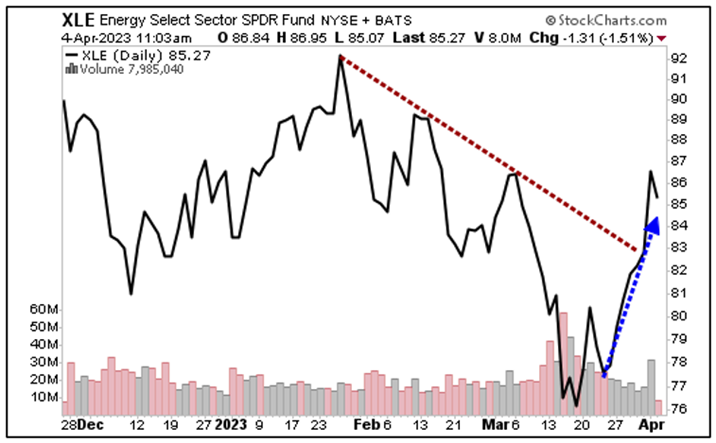

You can see the XLE was already rallying off its lows, and the OPEC+ news sent it surging through its downtrend. My preliminary target on the XLE is $109. But it could go higher than that.

And if I’m wrong about the timing of the next oil rally? Well, the XLE has a fat 4.64% dividend yield, so you’ll be paid to wait.

You could also drill down into the XLE’s holdings to buy individual energy names. Individual stocks carry more risk but offer bigger rewards.

But whatever you do, don’t miss out on this next big leg higher in oil. Mark my words, we’ll see $5/gallon gasoline this year. You can prepare and profit or end up running on empty.

Recommended Action: Buy XLE.