We live in interesting times as investors push stocks higher even with recession indicators sending a strong warning. However, that rise is not broad-based and is a function of strong performance by FANG stocks. Someone is going to be wrong about the market, writes Lance Roberts, editor of The Bull Bear Report.

Interestingly, we saw much of the same in 2021 as investors piled into the top-10 stocks through passive indexing. And we know that in 2022, just one month after a post I made about it, the market reversed course sharply in those same stocks.

However, in the short term, there is no denying the underlying bullish tones. Despite many headlines, “YouTube experts,” and media analysts regurgitating narratives of “crisis” and “doom,” the market has continued to rise since the lows of October.

Importantly, from a bullish perspective, the markets held the December lows, confirming previous support levels. While the market is challenging the downtrend from the April 2022 peak, a breakout of the consolidation range from June 2022 would suggest a significant move higher.

Since 2008, there have been five successful tests of that ongoing bullish trend, with October 2023 being the most recent. With the market retesting and holding above the 40-week moving average, such confirms both the long-term and short-term bullish trends are intact.

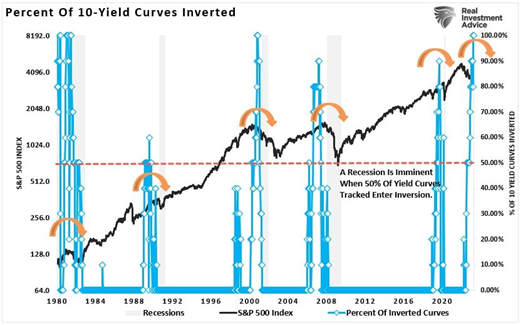

But many of my indicators are highly correlated to the economy and have a long record of accurately predicting economic expansions and contractions. The most apparent indicator to discuss is the “yield curve.”

It is not the inversion of the yield curve that denotes the recession. The inversion is the “warning sign,” whereas the un-inversion marks the start of the recession, which the NBER will recognize later.

We track ten economically sensitive yield spreads. Currently, 100% of the 10-yield spreads we track are inverted. Historically, a recession follows whenever more than 50% of those spreads are inverted. Every. Single. Time.

But analysts don’t think a recession is coming. They expect a soft landing and they are raising earnings estimates as a result.

As investors, we must acknowledge the “possibility” of a soft-landing scenario. However, as noted above, the “probabilities” of a recession seem significant. The challenge will be discerning who is right or wrong.

All we can do for now is continue to follow our portfolio guidelines, focus on our technical indicators, monitor short-term risks, and adjust allocations accordingly.

While we did increase our equity exposure over the last two weeks, we remain decently underexposed to equities. However, that amount of equity exposure remains challenging, given that recessionary risks have increased. We will adhere to our discipline accordingly to help offset our base emotional reactions.