The stock market will remain weak to reflect slower economic conditions, lower profits, tight monetary trends, and a severe lack of liquidity as reflected by the decline in monetary aggregates and bank deposits. But I still find bonds and gold attractive, explains George Dagnino of Peter Dag Strategic Money Management.

The yield curve is an important leading indicator of the economy. Its trend has been predicting slower economic growth since mid-2021. The difference between the 10- and the 2-year Treasuries is negative, pointing to continued economic weakness.

The continued inversion of the yield curve and other leading economic indicators also suggest weakness in business activity will remain a major headwind for corporate profits.

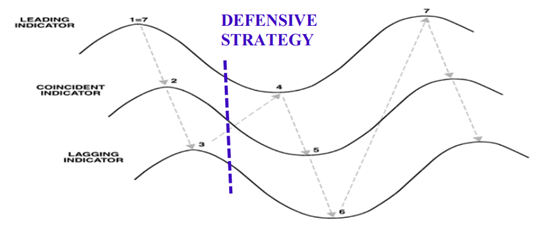

As for the stock market, my long-term outlook remains cautious. The economy and the markets are behaving exactly as shown in the above lines. The decline in liquidity (ROC of profits and M2) has been followed by a slowdown in production, and a decline in commodities and interest rates.

Inflation has been declining after about eighteen months from the peak in M2. Bond yields are also declining, reflecting lower inflation and a weaker economy.

The system is self-correcting after the orgy of excesses caused by the government and the Fed in response to the pandemic. The system must heal. It will take time. Short-term interest rates must decline for several months, and the yield curve needs to steepen. Only then will the leading indicators (M2, stock prices, profits) resume their bullish trends.

Strategy: My strategic equity model is defensive. Bonds and gold remain attractive.