The market is still like a jar of mixed nuts. Some good, some bad. One of the good ones is Alphatec Holdings (ATEC), a MedTech company with surgical solutions for spinal conditions, counsels Tyler Laundon, editor of Cabot-Small Cap Confidential.

Earnings season is beginning this week. Across small-, mid- and large-cap stocks (all sectors) earnings estimates have been trending down for several quarters. That’s not great.

But what’s also interesting is that forward revenue expectations have not been coming down. The implication is that, broadly speaking, profit margins are going to take a hit in 2023. In other words, corporate revenue may be near record highs, but companies will make less per dollar of revenue than last year.

Rising costs and softening demand is not a great mix, especially when interest rates have been cranked up and recession odds are rising. And did I mention there’s still risk of financial contagion from small and regional banks? It all sounds pretty dire.

But the stock market tends to look forward about a year. And we could be in much better shape heading into the back of 2023, especially if the current rolling recession rolls on through without snowballing into a full-blown recession.

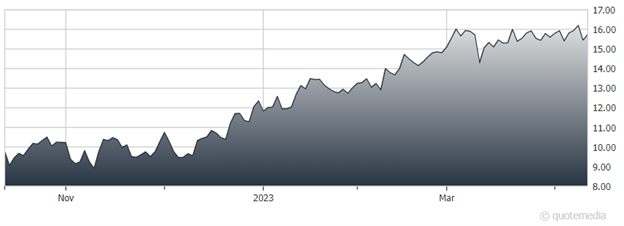

Alphatec Holdings (ATEC)

Now, let’s talk about ATEC. Whereas some companies offer a smattering of products for spine surgery, Alphatec reorganized its business a few years ago so that it could offer a soup-to-nuts product lineup. The team has developed surgical procedures, body positioners, surgical tools/access systems, informational systems for pre-, intra-, and postoperative care, implants, fixation systems, and biologics.

It’s an example of a company that embodies the spirit of a pure play – either it’s going to win in spine or … well, if it doesn’t win it will probably end up selling itself off to one of the more diversified MedTech companies. But right now, Alphatec is winning. The trends are very good.

Alphatec has posted average annual revenue growth of 41% since 2018. Revenue grew by 44% (to $351 million) in 2022 and was up by 43% in each of the last two quarters. Earnings are negative, but losses are getting smaller. EPS was -$1.50 in 2021 and -$1.47 in 2022.

The company is expected to grow 2023 revenue by 25% (to $440 million) and 2024 revenue by 20% (to $530 million). EPS loss is expected to improve by 56% in 2023 (to -$0.64) and by another 42% (to -$0.37) in 2024.

Recommended Action: Buy ATEC.