The broad markets have improved nicely in the past month, albeit with a recent pullback. Here at Cabot, we’re delighted by the rebound, but remain cautious. Judicious stock picking is the key to a prosperous and progressive portfolio. One company worth investigating is TransMedics Group (TMDX), explains Nancy Zambell, editor of Cabot Stock of the Month.

The backbone of TMDX is its Organ Care System (OCS), a portable device that keeps donor organs warm and functioning almost as if they are still in a human body. The company is also able to monitor organ health.

It’s an example of a company that’s revolutionizing a market that not only is great for humanity but also is becoming a really viable business. Lots of work to do and very logistics-heavy with many challenges but an exciting story that not many investors are aware of.

There are hundreds of thousands of people around the world dealing with end-stage organ failure. The underlying causes are demographic trends contributing to chronic disease. The solution is organ transplant. And there are loads of people that have elected to donate organs after their death.

But the standard of care for organ transplant storage—cold storage organ preservation—just isn’t cutting it. Cold storage basically consists of flushing a donor organ with cold pharmaceutical solution, putting it in a plastic bag, and putting it on ice in a cooler.

Organs on ice, with no oxygenated blood supply, don’t last that long. They get injured (i.e., ischemia). Since they’re not functioning, there’s also no way to assess their viability for transplant. And there’s no real way to tweak how these organs are handled to optimize their use for transplant.

The end result is that damaged organs can lead to post-transplant complications. Or they are too damaged to be any good and are just thrown away.

TransMedics Group (TMDX)

TMDX addresses the unmet market need for more and healthier organs for transplantation, specifically in the heart, lung, and liver markets, with OCS. This is good for patients (better access to life-saving transplants and quicker recoveries), hospitals (higher transplant volumes, better procedure economics) and for insurance payers (more cost-effective treatment for end-stage organ failure and lower post-transplant complication costs).

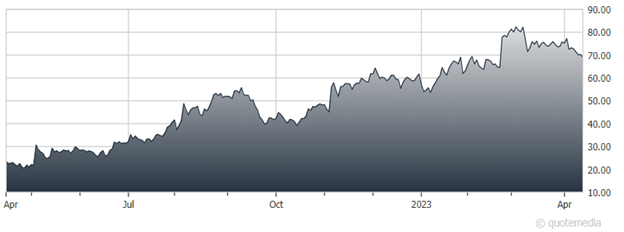

The company’s fourth-quarter revenue jumped 225% year over year, and sales for the full year were up 209%, to $93.5 million. As an early-stage company, TransMedics is not yet earning any money. But its revenue growth has been astounding.

For 2023, TransMedics’ management sees that continuing, albeit at a slower rate. The team expects total revenue to climb between 48% and 55% in 2023.

Recommended Action: Buy TMDX.