Sterling Infrastructure (STRL) is a new stock we’re adding to our “SMid-Cap Value Portfolio”. The Texas-based company operates mostly in the U.S. and has three reporting segments: E-Infrastructure, Transportation, and Building Solutions, explains Kuen Chan, editor of The Complete Investor.

The E-Infrastructure business focuses on large-scale site development systems and services for data centers, e-commerce distribution centers, warehousing, transportation, energy (including solar and EV battery plants) and other facilities.

The Transportation Solutions segment is involved in building and repairing transportation infrastructure such as highways, bridges, airports, ports, and storm drainage systems, relying largely on federal and state infrastructure spending.

The Building Solutions segment is involved in concrete work, such as foundations for residential and commercial buildings, parking structures, and other projects.

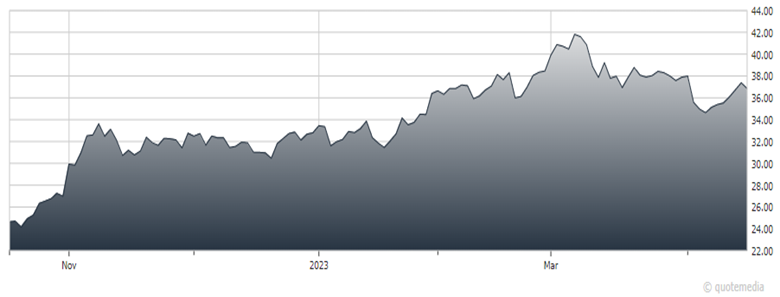

Sterling Infrastructure (STRL)

The company benefits from macro trends favoring clean energy and digitalization, which in turn spurs growing demand for data centers and next-generation battery plants. Meanwhile, America’s aging infrastructure is badly in need of upgrade.

It doesn’t hurt that infrastructure spending is one way for politicians to boost the economy. Recent favorable legislation includes the Infrastructure Investment and Jobs Act of 2021 that provides for $1.2 trillion in federal spending over five years on America’s infrastructure including roads, bridges, airports, and much more. This greatly expands the market opportunity for Sterling.

As for the Building Solutions segment, softness in the housing market is an ongoing challenge. But segment revenue in 2022 still grew 1.3% and segment operating income increased 12.7%. Key housing markets for Sterling are several metropolitan hubs in its home state of Texas, which is holding up comparatively well compared to national figures.

As of year-end 2022, Sterling had $1.41 billion worth of backlog. The company had another $275 million of unsigned contracts that were likely to be signed—it’s the lowest bidder. The $1.41 billion figure represents 6% growth on a year-over-year basis, certainly not breathtaking, but solid nevertheless.

In terms of valuation, the stock checks all the value boxes. Its price/book ratio is 2.3, price/sales is 0.6, and its forward price/earnings is 10. The PEG ratio is a very cheap 0.56.

Recommended Action: Buy STRL.