Headquartered in Houston, Cactus, Inc. (WHD) designs, manufactures, sells, and rents a range of highly engineered wellhead and pressure control equipment. It should generate respectable revenue growth and total returns, writes Doug Gerlach, editor of Investor Advisory Service.

Every oil and gas well requires a wellhead system, which is installed throughout the drilling process and remains with the well through its productive life. The company’s strong brand has resulted in over 40% share in the U.S. onshore wellhead market and its marquee product is also where the “WHD” ticker originates from.

For the completion phase of a well, the company rents various products to help with well control and the transmission of fluids and proppants (usually sand) during the hydraulic fracturing (‘fracking’) process.

For the production phase, the company sells production trees and equipment. Cactus also provides field services for its products and rental items to help with the installation, maintenance and handling of wellhead and pressure control equipment.

Cactus Inc. (WHD)

Founded by brothers Scott and Joel Bender, the company began operations in 2011 and went public in 2018. It primarily operates through service centers in the U.S. that are strategically located near important oil and gas producing regions.

Over the past year about two-thirds of revenue came from product sales, primarily wellhead systems and production trees. Service revenue accounted for 22% of total revenue and rental revenue comprised the remainder.

Given its industry, the company has reasonable diversification across its customer base, serving more than 200 customers with no customer accounting for more than 10% of revenue over the past year. Cactus’s core customers tend to be larger oil producers who are less reactive to short-term fluctuations in oil and gas prices.

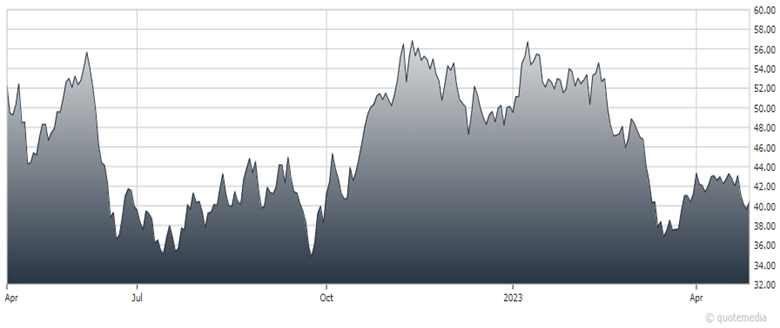

Regardless, it should come as no surprise the company’s stock price has been correlated with energy prices, as company performance is dependent on the overall level of activity in the oil and gas industry. Given its highly engineered, differentiated products and services, the company boasts relatively attractive margins, and over the past several years EBITDA margin has been in the mid-30% range. “EBITDA” is earnings before interest, taxes, depreciation, and amortization, and serves as a measure of cash flow.

We anticipate Cactus will grow revenue 12% a year over the next several years with EPS growth averaging 14%, helped by modest margin expansion. Projecting 14% EPS growth over the next five years and applying a high P/E of 27.7, we get a potential high price of 96.

Multiplying last year’s EPS by a low P/E of 14.8 results in a low price of 27 and an upside/downside ratio of 3.3 to 1. The projected high total return is over 18% annually.

Recommended Action: Buy WHD.