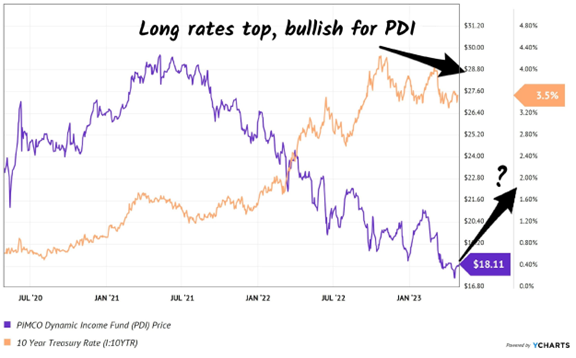

Rates are topping. The 10-year yield peaked last fall. Bond traders looked ahead and saw inflation numbers coming down. Or a recession. Or both. That’s why we are buying PIMCO Dynamic Income (PDI) again, explains Brett Owens, editor of Contrarian Income Report.

The fund pays a fantastic 14.6%. Fourteen-point-six percent! Plus, PDI dishes the cash monthly to the tune of $0.2205 per share.

Now, PDI does trade at a slight (3%) premium to its NAV. Usually we demand a discount, but we’re making an exception in this case because PDI’s NAV should continue to gain as long rates drop.

If we sit around and wait for a discount in PDI, we might be waiting awhile. The fund usually trades at an 8% premium. It’s a popular fund that is rarely cheap, and rightfully so.

I’ll admit, I’m a PIMCO fanboy. My summer reading recommendation is The Bond King: How One Man Made a Market, Built an Empire, and Lost It All.

Most of us dividend investors know the “Bond King” Bill Gross. He was Morningstar’s Fixed Income Manager of the Decade from 2000 to 2009. Gross netted 7.7% yearly returns for his investors—a big return from bonds.

Sure, Bill loaded the deck in his favor. He bought bonds that his benchmark “competitor” iShares Core US Aggregate Bond ETF couldn’t. Like higher-paying paper such as junk bonds, which boosted Gross’s returns and yields.

The New York Times once wrote that Gross was on the US Treasury’s “speed dial.” That’s a gross thought (sorry, had to) for us free market lovers.

But, for us profit-loving contrarians, I have another idea. Let’s hold our noses and invest alongside the guy who is so connected.

That said, all kings are eventually deposed. Gross, of course, left his PIMCO throne years ago. A tide of cash followed him out the door.

But the flow of money quickly stopped when successor Dan Ivascyn stepped to the plate and began banging out bond doubles himself. (Hence Dan “Beast” Ivascyn, according to his work colleagues.)

No wonder PIMCO let the King walk out the door – they had a Beast in waiting!

Recommended Action: Buy PDI...