New York just announced a ban on new natural gas hookups starting later this decade. Then Texas imposed major new restrictions on wind and solar deployment. These are the latest manifestations of the culture war coming to the historically arcane world of energy. But there’s ample evidence the best in class companies are successfully navigating these new challenges. That includes Duke Energy (DUK), notes Roger Conrad, editor of Conrad’s Utility Investor.

Both of the states mentioned above released plans to spend billions of taxpayer money to build new renewable energy and natural gas generation, if the private sector doesn’t jump fast and high enough. Not to be left out, Congressional Republicans passed legislation to undo the Biden Administration’s two-year solar panel tariff relief. The House is also threatening to trigger a first-ever US default if Inflation Reduction Act subsidies aren’t unwound, just as the Biden Administration is rolling out all-new restrictions on fossil fuel use including transport.

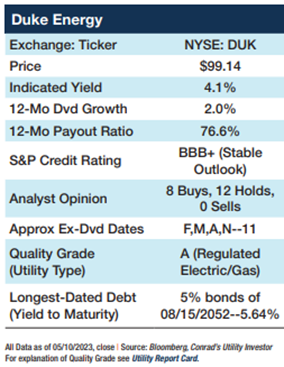

It’s imperative for investors to avoid utilities and energy companies that get caught in the middle of this energy culture war. And companies like conservative holding DUK should be fine.

Back in 2003, Duke Energy was a sprawling utility conglomerate. Its global portfolio of assets included real estate management, an Ecuadorian wireless phone, and Australian natural gas pipelines.

Back in 2003, Duke Energy was a sprawling utility conglomerate. Its global portfolio of assets included real estate management, an Ecuadorian wireless phone, and Australian natural gas pipelines.

That’s when management began a long transition back to its regulated electric utility roots, selling assets, paring debt, and investing in rate base. And later this year, Duke will finish the journey by selling its commercial renewable energy business, turning the company’s focus squarely on its $145 billion, 10-year utility CAPEX plans.

That includes $65 billion targeted through 2027, which management now expects to fund without issuing equity. Spending is already largely approved by regulators in the states Duke serves—the Carolinas, Florida, Indiana, Kentucky and Ohio—with the company in late April announcing a partial settlement in its omnibus North Carolina rate case.

Utility CAPEX is the primary driver of the company’s target annual 5 to 7 percent earnings growth, with commensurate dividend growth. And management has now extended that guidance though 2027.

Roughly half of the planned CAPEX is devoted to renewable energy expansion. The rest will go to grid modernization, including electrifying transportation and upgrading gas distribution utilities that now contribute roughly 10 percent of profits.

Finally, Duke has many levers to pull for substantial debt reduction, including the pending sale of its renewable energy unit and possibly gas utilities. Success would be a meaningful upside catalyst for the stock.

Recommended Action: Buy DUK up to $100.