Apparent progress on debt ceiling negotiations in the US appears to be behind yesterday’s bullish price bar on the S&P 500 (SPX), while renewed talk of a dream scenario ‘soft landing’ for the economy also helped to bolster sentiment, states Ian Murphy of MurphyTrading.com.

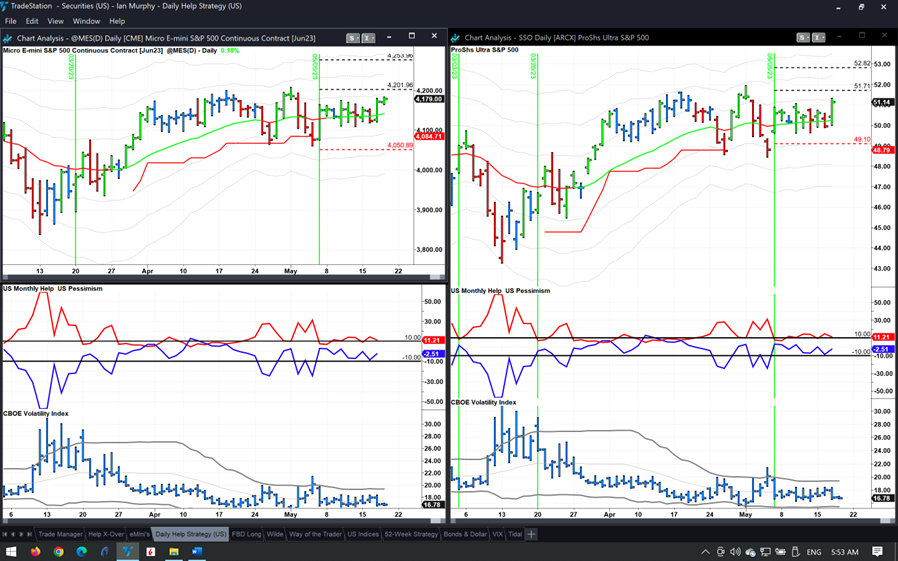

The move to the upside could mean the current trade in the Help Strategy might not be a "nothing burger" after all.

Yesterday’s price bar on ProShares Ultra S&P500 2x Shares (SSO) (right) was the most positive since the trigger on May 5 and it came within a whisper of the first target, falling just 41c short. Meanwhile, the Micro E-mini trade is seriously trying to hit its first target in overnight trading (left).

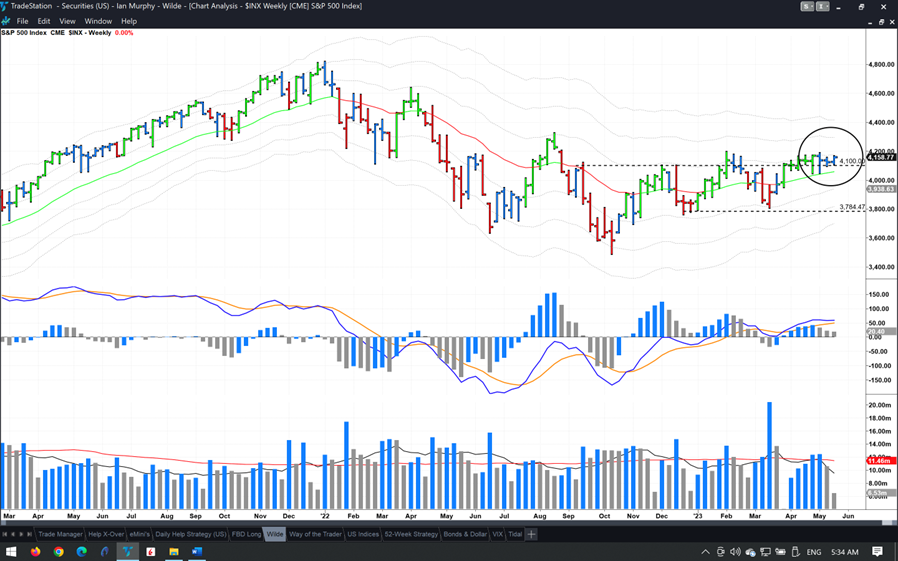

On the longer weekly time frame, the S&P 500 has once again punched through the resistance ceiling identified in trading posts a few weeks ago. A close of the weekly bar above the 1ATR line remains elusive with 4178 being the key number to watch tomorrow (circle).

Learn more about Ian Murphy at MurphyTrading.com.