When gold was discovered in 1848 in the Sacramento Valley, Sam Brannan held a one-man parade in the center of town to spread the news. Right now, 175 years later, a new gold rush is underway. Oracle Corp. (ORCL) is a key beneficiary, advises Jon Markman, editor of The Power Elite.

What Brannan — the owner of the General Store — did not tell onlookers was that a week before, he bought every pickaxe and shovel in the entire city. As the gold rush hit full swing in 1849, Brannan was earning $4 million a month selling tools to miners.

Now, a precious commodity has been discovered and the largest enterprises in the world are tripping over each other to stake claims. Investors have the rare opportunity to be the next Brannan. It’s all there for the taking in these three areas: Connectivity, electric transport and AI.

Have you noticed that everything is now connected? Your phone, computer, watch and even your car now all live on the internet, breathing in and exhaling valuable data. There is a giant ecosystem built around collecting and mining this valuable digital exhaust. And the trend is not going away.

Indeed, cloud computing networks, vehicle electrification and AI offer generational opportunity to investors because the trends are undeniable. Enterprises have mobilized. Significant preliminary investment has occurred to make the transition.

One of the best ways to profit is by targeting ORCL. Oracle is a global software company headquartered in Redwood City, California. The firm grew to prominence as one of the largest providers of database, middleware and application software in the world.

Revenue at Oracle increased from $23.25 billion in 2009 to $42.44 billion in 2022, representing a solid CAGR of 4.7%. However, Oracle executives are in the process of remaking the business.

The company has invested heavily in the field of AI datacenters, which are designed to optimize the performance and efficiency of cloud computing. Oracle claims that its AI data centers can deliver up to 10x faster throughput and latency than conventional data centers.

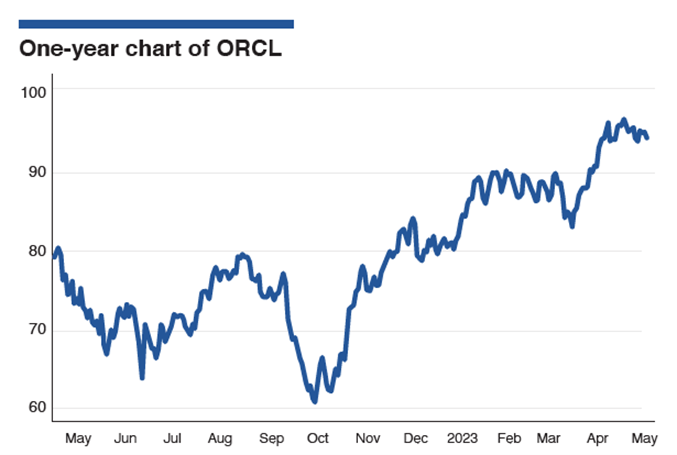

At the time of writing, shares of Oracle are up around 13% year to date and up over around 26% in the past six months. The stock pays a modest dividend yield of 1.69%. Recent earnings were also encouraging, as the company posted a 17.93% year-over-year increase in revenue in Q1 and earnings per share of $1.22 beat expectations.

Recommended Action: Buy ORCL.