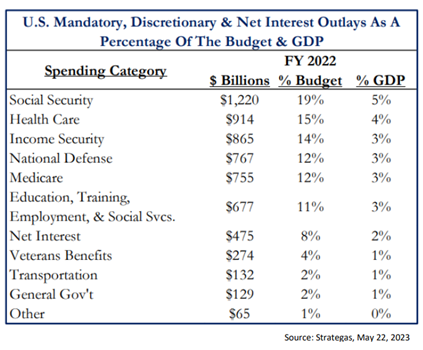

In light of the recent Debt Ceiling Circus, it seems relevant to consider some information from our friends at Strategas. If you look at the table below, you’ll see 60% of the budget is consumed by entitlements which are automatically renewed without Congressional approval annually. Meanwhile, the disconnect between the bears and the market continues, explains Nancy Tengler, CIO at Laffer Tengler Investments.

Now add interest payments, which currently represent 8% of the budget and are rising. Half of the debt outstanding matures in the next three years and carries an average cost of 1.84%, which will obviously increase. That’s important data to keep in mind given the latest round of debt ceiling drama.

Moving to the markets, as we have noted, the bears rarely get to be in charge and are loathe to exit center stage. Though we continue to expect volatility as we move past the Debt Ceiling Circus in Washington, we remain cautiously optimistic that our bullish tilt last fall will continue to be supported by stock prices.

One important thing that investors seem to be missing is that corporate profits are tied to NOMINAL GDP. And nominal GDP growth usually stays positive when the US economy enters recession. There are two three-sigma event exceptions: The GFC and 2020.

During the 1970s and 1980s, nominal GDP growth averaged 4-5% when the economy went through deep recessions. The correlation between nominal GDP and earnings is very high. So, it should be no surprise that 78% of companies have beaten market expectations. We have seen guidance raised and in some cases, margin expansion.

Our focus on tech last fall was rewarded and should be taking a break. The secular tailwinds behind cloud, AI, robotics (the digital economy is over 10% of GDP with plenty of room to grow) has informed our theme of buying old economy companies embracing the digital revolution and the arms dealers who facilitate.

One of the reasons tech continues to be interesting is that CDS (Credit Default Swap) spreads are lower than US debt: 5-year government CDS= 67 bps. AAPL (27 bps) and MSFT (45 bps) and AMZN (47 bps).

The handwringing over SPX valuation is a false flag. The equal weighted SPX is up 0.7%-ish so far this year vs. over 7% for the cap-weighted index. We all know why. But it is important to note. Ex. FAAMNG the multiple is much more reasonable at around 15x.

Subscribe to Laffer Tengler Commentary here...