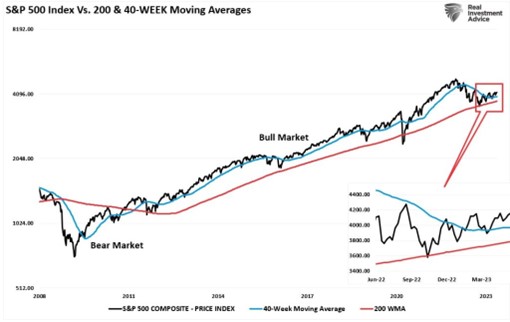

A technical review of markets can help manage shorter-term risks. Currently, the debate is about the market rally from the October lows. Is it a resumption of the 2009 bull market trend or an extended bear market rally? Unfortunately, I don’t have the answer. But while there are many reasons to be bearish on the markets, it is essential to remember that “stocks climb a wall of worry,” explains Lance Roberts, editor of The Bull Bear Report.

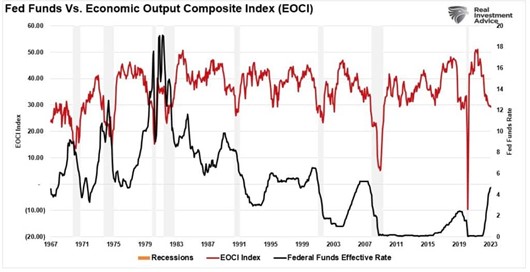

The bearish case is compelling, given higher interest rates, increased debt levels, and slowing economic activity. Our Economic Composite Index (which comprises more than 100 data points) suggests the economy will enter a recession over the next six months.

However, the bulls can also make a compelling case. The technical dynamics and improving earnings are certainly supportive of the rally. Technically, the correction from January 2022 to the long-term bullish trend line of the 200-week moving average is complete. With the market holding that support and moving above the 40-week moving average, it provides further validation.

Fundamentally, earnings are expected to grow rapidly through the end of 2023 and break above the 2022 peak, too.

Of course, such a strong technical and fundamental recovery in earnings must result from an economic expansion. The problem is that view contradicts the current economic data.

So, which view is correct?

Again, I have no idea. As such, we must focus on the shorter-term technical market view to manage investment-related risks. The bulls are clearly in control of the market currently. But the market is being driven by a narrow advance in the mega-capitalization stocks. The narrowness of the market advance is potentially an issue if it doesn’t broaden out.

The current market advance looks and feels like the Dot.com advance in 1999. How long it can last is anyone’s guess. However, importantly, it should be remembered that all good things come to an end.

Sometimes, those endings can be very disastrous to long-term investing objectives. This is why long-term returns tend to take care of themselves by focusing on “risk controls” in the short term and avoiding subsequent major draw-downs.