If you are looking for a high-quality dividend growth company, you will be very interested in our next undervalued stock, Williams-Sonoma (WSM), the upscale home goods retailer. In this article, we will determine if the company is undervalued and deserving of our hard earned money, says Prakash Kolli, editor of Dividend Power.

WSM is an American retailer with a prominent position in upscale home furnishings and gourmet cookware. With its origins dating back to 1956, Williams Sonoma has established itself as a leading brand offering many high-quality and sophisticated products designed to elevate its customers’ culinary and home experiences.

WSM stock was recently down 48.6% since its all-time high in November 2021. The main reason for the share price decrease has little to do with the company itself, as earnings are expected to decrease 13% in 2023, but increase 7% in 2024, which is still over a 100% rise since 2019. Instead, it is due to the overall market being down since then. Also, the stock was very much overvalued in November 2021.

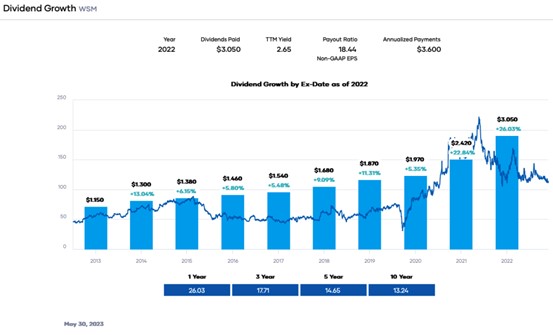

But now, WSM is considered a Dividend Contender, a company that has increased its dividend for over 18 years. WSM’s most recent dividend increase was 15.4%, announced in March 2023.

Additionally, WSM has a five-year dividend growth rate of about 14.65%, which is impressive considering how fast inflation increased last year and this year. The 10-year dividend growth rate is roughly the same rate of ~13.2%. However, the dividend growth rate has been increasing in recent years.

Something worth noting is that WSM continued to pay its dividend during the most challenging period in the last 100 years. Many businesses and industries cut or suspended dividend payments during the COVID-19 pandemic. This fact alone leads me to believe in the strength of the company and how management is focused and committed to the dividend policy.

The company has an excellent dividend yield of approximately 3.17%, higher than the average dividend yield of the S&P 500 Index. This dividend yield is an excellent initial yield for dividend growth-driven investors. Additionally, with the company’s recent dividend increase rate, I can see over 5% yield-on-cost (YOC) in the next eight years.

Meanwhile, WSM revenue has been growing reasonably at a compound annual growth rate (CAGR) of about 7.9% for the past ten years. Net income did much better, with a CAGR of ~16.8% over the same ten-year period.

Recommended Action: Buy WSM

Subscribe to Dividend Power here...