Ulta Beauty (ULTA) reported first quarter sales increased a pretty 12% to $2.6 billion with net income up 5% to $347.1 million and EPS up 9% to $6.88. Strong 9.3% comparable sales growth was driven by an 11% increase in transactions and a 1.5% decrease in average ticket, notes Ingrid Hendershot, editor of Hendershot Investments.

Loyalty member growth increased 9% during the quarter to 41 million people. Gross profit increased 12.1% to $1.1 billion and ticked slightly lower as a percentage of sales to 40.0% from 40.1% in the prior year period due to higher inventory shrink, lower merchandise margins and higher supply chain costs.

Operating income increased 1% to $442.1 million, reflecting the deleverage of selling, general and administrative expenses. Free cash flow declined 45% during the quarter to $195.1 million due primarily to an increase in inventories to support higher demand, product cost increases, 41 net new stores, new brand launches and brand expansions.

During the first quarter, the company repurchased 541,108 shares of its common stock for $285.8 million or an average cost per share of $528.18 per share. Ulta has $816.5 million remaining authorized for future share repurchases.

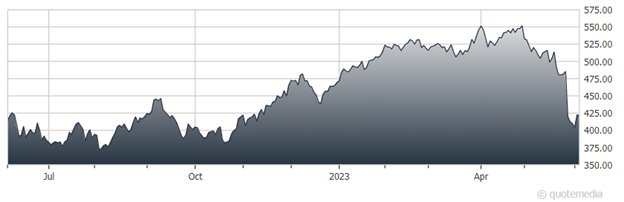

Ulta Beauty (ULTA)

The company ended the quarter with an attractive balance sheet with more than $636 million in cash, no long-term debt and $2.0 billion in shareholders’ equity. Ulta Beauty raised its revenue outlook for the full year to $11.0 billion to $11.1 billion with comparable store sales growth of 4% to 5% still expected.

The company continues to expect to open 25-30 new stores and remodel or relocate 20-30 stores. The company’s operating margin outlook was lowered to a range of 14.5% to 14.8% from its previous outlook of 14.7% to 15.0% due to an increased promotional environment and increased shrink (organized theft from retailers is an ongoing problem).

Nevertheless, increased interest income and a lower expected tax rate led Ulta Beauty to reaffirm its EPS outlook in the range of $24.70-$25.40 for the full fiscal year with share repurchases of approximately $900 million expected for the year.

Recommended Action: Buy ULTA.