Hecla Mining Co. (HL) is the newest addition to the Silver Stock Investor Portfolio. Hecla comes with a very long and storied history. Established in 1891 in North Idaho’s fabled Silver Valley, Hecla is the oldest US-based precious metals mining company and the largest primary silver producer in the United States, shares Peter Krauth, editor of Silver Stock Investor.

In fact, Hecla accounts for more than 45% of all silver mined in the country. With a $3.4 billion market cap, Hecla is also the third-largest lead and zinc producer in Canada, with exploration properties in some of the top silver and gold mining districts across North America.

The company’s operational strategy is to focus on long-lived mines in safe jurisdictions. In fact, their top four mines are in the top 10 regions worldwide for investment attractiveness: Alaska, Quebec, Idaho, and Yukon.

Greens Creek, Admiralty Island, Alaska, is the largest silver mine in the US. It’s an underground mine that last year produced an impressive 9.7 Moz silver, 48,200 gold ounces, 195 000 tons of lead and 523 000 tons of zinc. With all-in sustaining costs, after byproduct credits, of just $5.77/silver ounce, Greens Creek is one of the largest and lowest-cost primary silver mines in the world. This is the company’s cash cow.

Lucky Friday is Hecla’s next most important silver mine, contributing 20% of total company revenues. It’s one of the top seven primary silver mines globally, and though it’s been operating since 1942, it still has 20-30 years of mine life ahead. Last year, Lucky Friday produced 4.4 Moz silver, 29,200 tons of lead and 12,400 tons of zinc.

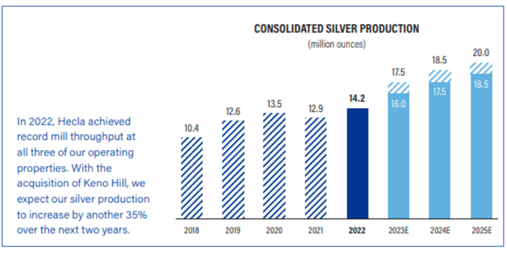

Nearest term growth will come from Keno Hill, followed by ramp up at Lucky Friday. Hecla has a respectable exploration budget of about $32M for 2023. Greens Creek will get about 25% for resource expansion and to upgrade ore zones.

There aren’t many multi-billion-dollar miners that have a growth profile of over 40% in just the next three years, with silver production to increase by another 35% in the next two years. That should push silver revenues above 50% at current prices, which is a rarity these days.

Overall, Hecla is a great low risk way to play superb leverage to the silver price. High-grade mines, operating at low production costs, in the safest jurisdictions make Hecla a great long-term play on the secular silver bull market. I think we could see Hecla shares gain as much as 50% over the next 12 months.

Recommended Action: Buy HL.