The ink is still drying on the new bipartisan debt ceiling agreement. And, just when it seemed like the drama flowing out of Washington DC would fade, the biggest production in the nation’s capital is just starting: The quadrennial presidential election. But our practice is to cut out the noise and stay focused on promising stocks like Comcast Corp. (CMCSA), shares Bruce Kaser, editor of Cabot Value Investor.

If the November 2024 election, “only” 17 months away, is like recent past elections, the winner will be unpredictable until late into election night. The Senate and House elections will add further unpredictability – if neither party wins control of both chambers, the ability of whoever is elected president to implement their agenda will likely be limited.

We put predicting election outcomes in the same bucket as economic forecasts: Almost impossible to get right and unworthy as a foundation for picking individual stocks. The drama may be high, as will emotions, but investors will want to avoid having their investing become swayed by the political and media winds. Media of all types generate immense ad revenue during election seasons, and unfortunately, most are thrilled to overplay news to generate more attention.

By all means, fully engage in the personal voting process by evaluating and choosing candidates to reflect your views. However, this should be kept completely separate from the investing process, which is based on an unemotional analysis of company-specific fundamentals and risk/reward potential, which are usually completely unrelated to the election outcome. It’s going to be a fascinating 17 months.

Now let’s talk about CMCSA. With $120 billion in revenues, Comcast is one of the world’s largest media and entertainment companies. Its properties include Comcast cable television, NBCUniversal (movie studios, theme parks, NBC, Telemundo and Peacock), and Sky media.

The Roberts family holds a near-controlling stake in Comcast. Comcast shares have tumbled due to worries about cyclical and secular declines in advertising revenues and a secular decline in cable subscriptions as consumers shift toward streaming services, as well as rising programming costs and incremental competitive pressure as phone companies upgrade their fiber networks.

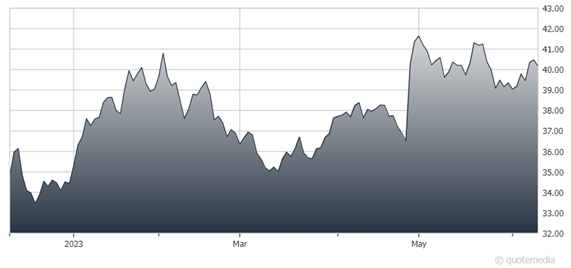

Comcast Corp. (CMCSA)

However, Comcast is a well-run, solidly profitable and stable company that will likely continue to successfully fend off intense competition while increasing its revenues and profits, as it has for decades. The company generates immense free cash flow, which is more than enough to support its reasonable debt level, generous dividend, and sizeable share buybacks.

There was no significant company-specific news in the past week. But Comcast shares have 16% upside to our new $46 price target.

Recommended Action: Buy CMCSA